First let's look at commodities as a group.

Now let's look at base metals

(neutral: direction not yet determined. Consolidation suggests big move coming soon)

Precious metals as a group

I am actually okay with a bullish position due to the falling wedge that tends to be a bullish consolidation. However, I would not be surprised to see potentially a 10% decline before the breakout and the volume profile above suggests it may be difficult to see gains much more than 10% initially. HOWEVER if prices can get past 10% to the upside or 10% to the downside there is room for a much larger move.

Agriculture Commodities as a group

In my opinion this is the most bullish of the group and remains buyer controlled and is resting after the past breakout within the context of an even greater consolidation and potential breakout. I would say there will be a resolution of this consolidation (breakout or breakdown with odds on breakout) by the early 2016 at the very latest and most likely before then.

Energy commodities as a group

Very oversold but volume profile remains very bearish and crude oil likely weighs very heavily on this fund which we have analyzed.

Gold

Although Precious metals may appear bullish, gold is actually looking bearish and I would not be surprised to see a 20% decline. The volume profile puts the sellers in control and there is not much support until just under $1000. Remember, new buyers can come in, however the volume profile tells us that a lot more new buying demand will have to come in to power past the overhead supply.. We can only analyze the odds and play the odds, predicting the future with certainty cannot be done.

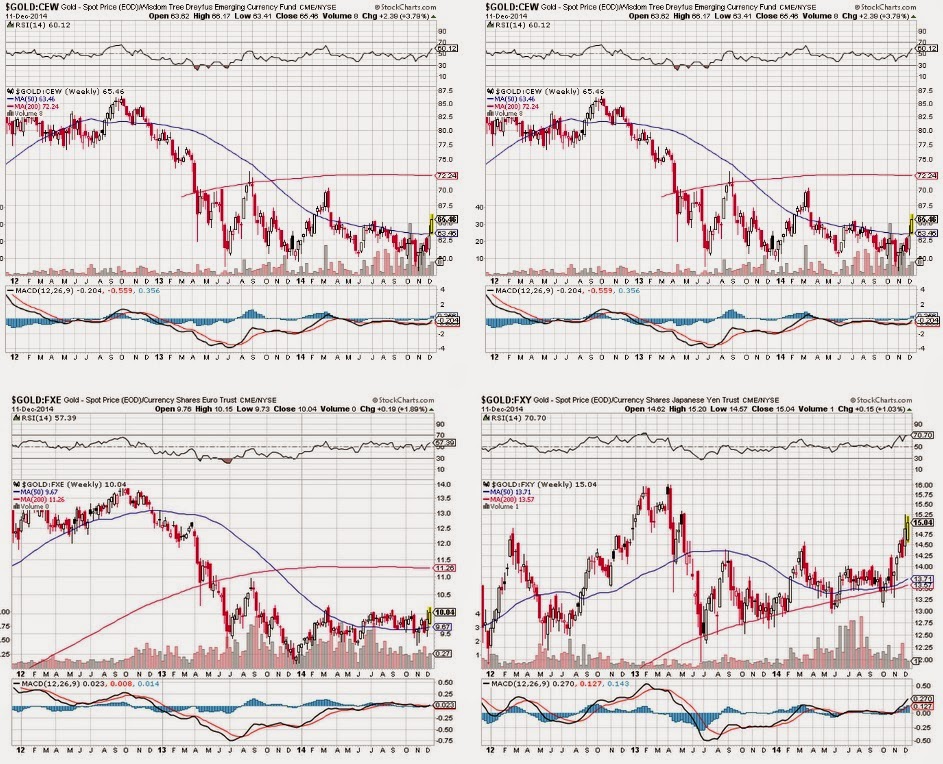

Similar to oil, gold's recent weakness may be a result of the dollar strength. We can look at gold relative to other currencies. If the dollar continues it's strength, Gold should begin to set up a bottom in other currencies first and show signs of a new trend before it starts to increase relative to the dollar.

Gold has not completely given up control on the euro, the yen, and possibly the canadian dollar. Vs other currencies I would say it is seller controlled and likely will see a break to new lows. We may even be starting to see an uptrend vs the yen and the euro and the bottoming process vs short dollar.

However, Silver has given up lows vs most of these currencies so it is entirely possible the dollar will strengthen dramatically and gold will flush in the dollar but perhaps hold in other currencies while silver and other precious metals may capitulate before it begins to lead. Alternatively the other interpretation may be that the bottoming process in gold vs other currencies will fail just as silver did and a flush may be needed before a bottom can be formed. In either case, even if gold is bottoming vs other currencies it is still early in the process and caution is still the way to approach it.

gold

Agriculture commodities

base metals

base metals Precious metals

Precious metalsFor oil see here.

----------------

In conclusion I think it is realistic to expect gold to flush and bottom just under $1000 soon and that the weakness in oil and strength in the dollar isn't necessarily effecting all commodities equally. It may be that most commodities are actually setting up for bullish moves in the future in spite of oil and gold. Nevertheless, many patterns although currently leaning bullish are still unresolved and could fail or turn very bearish and commodities as a group could still enter a full fledged bear market. Should this occur, it may result in a global capital concentration into one of the other main asset classes like stocks or bonds, possibly concentrated into one part of the world such as the US stock markets or US Treasuries.

No comments:

Post a Comment