It's been awhile since I've really updated the reader on some

specific action I have been taking. Well, I have mentioned my caution

approaching the budget talks. Now it's on more people's mind and the

market has dropped so I have cashed in. I may be a bit early here but I

am not so much concerned about timing at this stage of the game.

Based upon my view on Sector rotation and a secular bull market or parabolic

move, I have been accumulating some small positions in 2015 calls for

some aggressive bets. (Aggressive meaning strike price very far away,

not timing or position size). The plan will also be to buy some 2016

calls when they become available.

Just in terms of sectors, I am looking for the XLI (Industrials), the XLB (Materials) and

the XLE (Energy) to outperform specifically.

I will be perhaps be looking at individual names in those sectors with a

reasonably low PE, reasonably high growth rate and other fundamentals

that I like such as High ROE, High Margins and in some cases paying a dividend and having a history of growth.

When the time comes, particularly near the debt ceiling talks and Germany

elections of September, I may position for larger position sizes, and

begin trading on a shorter term time frame again. I also want some

strike prices that are not as aggressive that can still capitalize if I

am right about direction, but perhaps far too aggressive on my target.

So going forward the plan will be to get some options with less time

expense that are closer to the money..

There is a delicate balance between allocation strategies (adding lower to maintain

or increase percentage allocation to that particular asset), and

individual position trading (where you have a stop and profit target). I am trying to think of how I can more specifically define and determine that balance for given conditions.

I also am working on looking at historical data as well as individual setups to really try to maximize my allocation rebalancing period and/or price magnitude to trigger rebalancing in a way that optomizes my return. In other words, since there are commission costs, at what point can you let a trade run to based upon a random wakl before rebalancing is a break even strategy in a random walk given a particular position size? Also, at what point do you make that decision given a particular set of circumstances such as the market on a daily basis having a 55% chance of going up an equal amount as it will trade down on an average down day? What is the minimum "break even" position size given historical market data from November 1st to April 30th for X amount of trading days?

I want to look at various historical data to determine the probability of an up vs down day, and use that data along with running all permutations (possibilities) that the market can go up or down to determine how a 5 day trading period should expect to yield.

This way, I can actually derive long term data based upon short term information. In other words, stocks have never had a single decade where they closed lower than the start of the decade. Even 1920-1930 ended up. However, based upon simply looking at a series of possible outcoms based upon historical data, there is the possibility of it happening and you could in fact calculate the probability even though it hasn't happened yet.

Once you determine the odds of a series of trading days making up a wining or losing trading week, you can use that data to determine the probability for a given month, and then years, and then decades.

This will also help you determine what position size or bankroll you need in order for swing trading to provide a greater edge. If you have an edge beyond the historical averages the market has offered, perhaps you can use a limited sample size to weight the data with historical averages to provide a "safer" approach to deriving conclusions based upon trading systems. In other words, if a certain indicator over the last couple years since information is available has shown stocks go up 60% of the time when the signal was given, nd over the last 50 or 100 years you observe that just based upon seasonal data stocks have gone up 54% of the time, you perhaps can determine a number between 54 and 60% depending upon how relevant you think the sample was, and how confident you can be in the indicator going forwards. Of course it's also possible that the data you have used in seasonal data is less thn accurat and that data to be safe coul be watered down. Using statistics you could theoretically derive a "confidence interval" and be 90% confident that your seasonal data offers greater than X% return over the next 10 or 20 years or whatever. However, Personally I am going to avoid that because I think that gets people wrapped up a little too much on information that may or may not have been a valid enough sample size (or high enough quality). Afterall, I am not trying to nail down an exact strategy, just use some information to improve the accurcy some degree. I see no reason not to error on the side of caution and I don't see why you need to do all this work just todraw that conclusion.

Nevertheless, between a position sizing strategy that has a stop lower and a target higher with a given probability of it ahppening, and a strategy that uses broad based indexes or options on index to rebalance multiple asset classes higher and lower.

In addition there will be more to all of this but I must go now.

Wednesday, August 21, 2013

Great Video On Sector Rotation

This video really compliments what I have been saying and shows you how to approach "cycles" on various time frames.

linke to sector rotation video.

video embed

Summary:

You can look at the longer term business cycle. You will notice in order out performance by various sectors. The rotation is

financials, discretionary, industrials, materials, energy, staples, health care, utilities.

In the last year he notes that using the starting point of 1yr, financials lead. Using 6 months discretionary have outperformed. Using 3 month, industrials, and now using 1 month you are starting to see materials out perform.

When Staples, Health care, and Utilities start to outperform, that is when you should get worried about a top. That hasn't happened. By identifying the out performers, and perhaps even anticipating the "next" sector to go, you can narrow down your buy lists.

Once you have identified a sector, the key to deciding WHAT type of stock to buy is understanding the risk cycle.

There is a "risk cycle" that occurs. This "risk Cycle" basically is a much shorter time frame, but has to do with sentiment.

Basically, after any major or minor pullback/correction, "risk" is reset. You then will see the rotation begin again. That rotation is from "quality" names first as the institutional investors are selling off the worst but always holding onto the best names and when they start buying again, they start with quality. Once they see it stick, they rotate into higher risk and then are willing to bet on "momentum". When the confidence that a low is in is then there, then you can start to see even the areas that have really lagged start to play "catch up" Finally you have the bulls aggressively attack the short squeezers by going after the high short interest names, and then the shorts are forced to cover from the "garbage" kind of names. "garbage" meaning stocks under $10 that have been chronic long term decliners that have been entirely beaten down by shorts, particularly those that are not even listed on the major exchanges (OTC,pinksheets). These are the names the short sellers are shorting to zero, but at this point in the cycle, they will have to cover because of the short squeezes that occured in high short interest names. The bulls at this point in order to outperform will have been forced up the "risk latter".

What I have talked about before is how the sort of nature of risk occurs where mutual funds have to compete with a bench mark. They can have a lot of cash on the side when money market pays a high interest rate, and then as the interest rates are lower, maybe they have to shift into treasuries. And then they have to shift into higher risk, maybe quality income stocks and preferred shares or the higher grade bonds. Then into the higher yielding junk bonds and corporate high yielding bonds. Then into the S&P type of names, and then into smaller cap (russel) stocks and the high growth nasdaq stocks. Then into real estate and leveraged buyouts and venture capital and then they no longer can sustain high prices after credit cycle expands to it's maximum.

This is a similar concept to risk appetite only on a much different time frame as capital rotates. Not only are there "shifts" up the risk latter, but sometimes over periods of time there are "imbalances" This occurs when perhaps one particular market fails to recognize risk, or capital concentrates into one hot asset class. Sometimes this has reasons that are valid such as high potential for growth, global aversion to alternative assets, a flight from substantial risks that have been created over a very long time frame, and various rule changes or changing of laws that impact gains, such as tax rates, regulations, etc. There are other reasons for individual sectors. This can perhaps provide substantial long term value and over valuation in not only this "risk latter" but the short term "risk appetite" chart can produce either very short term "index arbitrage" plays or very long term idenification of rotations. One such rotation into 2000 was into the nasdaq as "growth" names really outperformed for a long period of time.

There is always a rotation of capital throughout the various asset classes. Understanding both the psychology and motivations and "cycles" behind these rotations can help you anticipate movement and get in front of the moves, and allocate capital to capitalize off of it.

linke to sector rotation video.

video embed

Summary:

You can look at the longer term business cycle. You will notice in order out performance by various sectors. The rotation is

financials, discretionary, industrials, materials, energy, staples, health care, utilities.

In the last year he notes that using the starting point of 1yr, financials lead. Using 6 months discretionary have outperformed. Using 3 month, industrials, and now using 1 month you are starting to see materials out perform.

When Staples, Health care, and Utilities start to outperform, that is when you should get worried about a top. That hasn't happened. By identifying the out performers, and perhaps even anticipating the "next" sector to go, you can narrow down your buy lists.

Once you have identified a sector, the key to deciding WHAT type of stock to buy is understanding the risk cycle.

There is a "risk cycle" that occurs. This "risk Cycle" basically is a much shorter time frame, but has to do with sentiment.

Basically, after any major or minor pullback/correction, "risk" is reset. You then will see the rotation begin again. That rotation is from "quality" names first as the institutional investors are selling off the worst but always holding onto the best names and when they start buying again, they start with quality. Once they see it stick, they rotate into higher risk and then are willing to bet on "momentum". When the confidence that a low is in is then there, then you can start to see even the areas that have really lagged start to play "catch up" Finally you have the bulls aggressively attack the short squeezers by going after the high short interest names, and then the shorts are forced to cover from the "garbage" kind of names. "garbage" meaning stocks under $10 that have been chronic long term decliners that have been entirely beaten down by shorts, particularly those that are not even listed on the major exchanges (OTC,pinksheets). These are the names the short sellers are shorting to zero, but at this point in the cycle, they will have to cover because of the short squeezes that occured in high short interest names. The bulls at this point in order to outperform will have been forced up the "risk latter".

What I have talked about before is how the sort of nature of risk occurs where mutual funds have to compete with a bench mark. They can have a lot of cash on the side when money market pays a high interest rate, and then as the interest rates are lower, maybe they have to shift into treasuries. And then they have to shift into higher risk, maybe quality income stocks and preferred shares or the higher grade bonds. Then into the higher yielding junk bonds and corporate high yielding bonds. Then into the S&P type of names, and then into smaller cap (russel) stocks and the high growth nasdaq stocks. Then into real estate and leveraged buyouts and venture capital and then they no longer can sustain high prices after credit cycle expands to it's maximum.

This is a similar concept to risk appetite only on a much different time frame as capital rotates. Not only are there "shifts" up the risk latter, but sometimes over periods of time there are "imbalances" This occurs when perhaps one particular market fails to recognize risk, or capital concentrates into one hot asset class. Sometimes this has reasons that are valid such as high potential for growth, global aversion to alternative assets, a flight from substantial risks that have been created over a very long time frame, and various rule changes or changing of laws that impact gains, such as tax rates, regulations, etc. There are other reasons for individual sectors. This can perhaps provide substantial long term value and over valuation in not only this "risk latter" but the short term "risk appetite" chart can produce either very short term "index arbitrage" plays or very long term idenification of rotations. One such rotation into 2000 was into the nasdaq as "growth" names really outperformed for a long period of time.

There is always a rotation of capital throughout the various asset classes. Understanding both the psychology and motivations and "cycles" behind these rotations can help you anticipate movement and get in front of the moves, and allocate capital to capitalize off of it.

Tuesday, August 20, 2013

Timeframe for 2009-2016 Sector Rotation

There is about 7 years to a cycle from the low to the top. Sometimes shorter, sometimes longer.

I believe we are looking at 2009 low to a late 2015-early 2016 high. It's possible that we just go on a secular run that extends into 2020. Being that I think we have a very high target that may be likely, but I also think we could see the type of "parabolic run" that we saw in the dow from 1927-1929 or the nasdaq from 1997-2000 or in the Nikkei. That could still get us to the price target and align with the cycle and Martin Armstrong's economic confidence model. Based upon how we are going, I think things are setting up for that.

Based upon this and an "even" timeframe between rotations, and this cycle chart we can translate the rotation into "time" as a guideline.

I came up with timeframes using the Financials as the bottom. I went with "strong dollar scenario" because that is what I think we see. I could be wrong, but if so the time frame is still very similar.

3/15/2009 Financials

12/5/2009 Cyclicals

8/28/2010 Transportation

5/20/2011 Tech

2/10/2012 Services

11/2/2012 Capital Goods

7/26/2013 Industrials

4/18/2014 Materials

1/9/2015 Energy

10/1/2015 Gold

Now you might want to round to the nearest seasonal point. Since we are in 2013

The only thing relevant right now is

7/26/2013 Industrials (if you aren't in, look for a buy in late September, early October)

4/18/2014 Materials (Probably want to get in January 2014)

1/9/2015 Energy (This date aligns very closely with seasonals )

10/1/2015 Gold (Could wait until say October 20th or so)

http://charts.equityclock.com/gold-futures-gc-seasonal-chart

http://charts.equityclock.com/silver-futures-si-seasonal-chart

I will not try to assess when the cycle will end what happens, but I suspect a typical 2-3 yr bear market which takes us into around 2018.

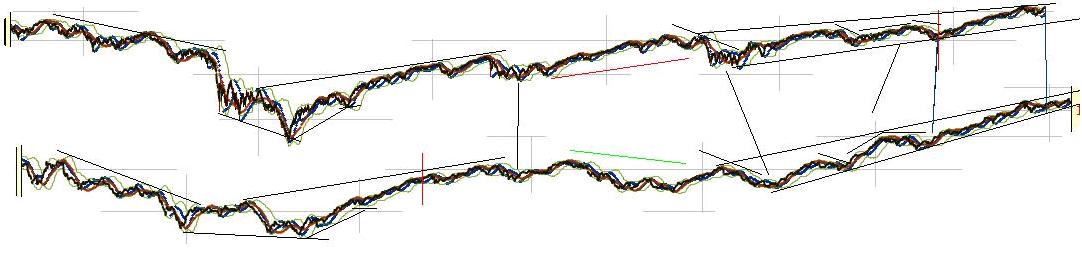

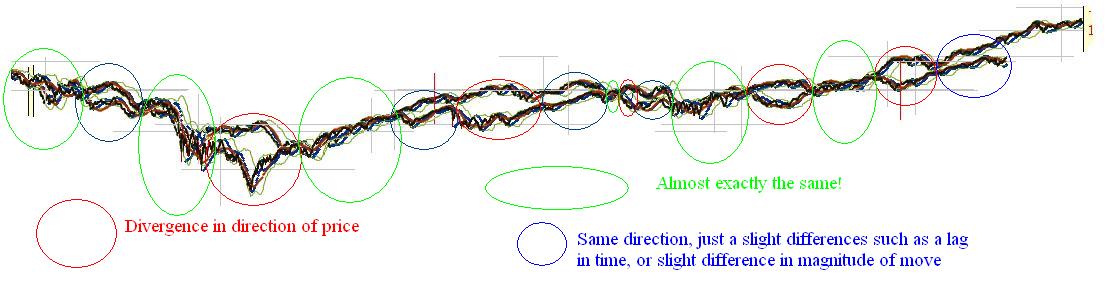

I would also consider using a comparison chart of all sectors to pinpoint what has happened and verify that this picture is relatively on track and perhaps pinpoint the beginning of a rotation. The sector rotation also provides a broad long term context, the seasonals provide a guideline for entry during that "context" and the technicals can help you pin point a more ideal buy point.

Then you can use individual fundamentals and technicals to decide what specifically to buy, or else just look at an ETF. If you are using an ETF, I believe you have an advantage in "rebalancing" since you can use that strategy to add lower, and effectively even change allocations to increase exposure slightly as you go lower. I would never do that with individual stocks, however, I may ADD a position or take a position off if I had a basket of a few in that sector, particularly if I made option plays. There are always multiple "fundamentals" and "technicals", so you gotta find what works for you.

You may not follow this "just because", but should perhaps tend to lean towards decisions that align with this. So perhaps you really don't like Industrials, so you just stay away or avoid going short, or if you have a slight dislike for them, have a much smaller position.

I believe we are looking at 2009 low to a late 2015-early 2016 high. It's possible that we just go on a secular run that extends into 2020. Being that I think we have a very high target that may be likely, but I also think we could see the type of "parabolic run" that we saw in the dow from 1927-1929 or the nasdaq from 1997-2000 or in the Nikkei. That could still get us to the price target and align with the cycle and Martin Armstrong's economic confidence model. Based upon how we are going, I think things are setting up for that.

Based upon this and an "even" timeframe between rotations, and this cycle chart we can translate the rotation into "time" as a guideline.

I came up with timeframes using the Financials as the bottom. I went with "strong dollar scenario" because that is what I think we see. I could be wrong, but if so the time frame is still very similar.

3/15/2009 Financials

12/5/2009 Cyclicals

8/28/2010 Transportation

5/20/2011 Tech

2/10/2012 Services

11/2/2012 Capital Goods

7/26/2013 Industrials

4/18/2014 Materials

1/9/2015 Energy

10/1/2015 Gold

Now you might want to round to the nearest seasonal point. Since we are in 2013

The only thing relevant right now is

7/26/2013 Industrials (if you aren't in, look for a buy in late September, early October)

4/18/2014 Materials (Probably want to get in January 2014)

1/9/2015 Energy (This date aligns very closely with seasonals )

10/1/2015 Gold (Could wait until say October 20th or so)

http://charts.equityclock.com/gold-futures-gc-seasonal-chart

http://charts.equityclock.com/silver-futures-si-seasonal-chart

I will not try to assess when the cycle will end what happens, but I suspect a typical 2-3 yr bear market which takes us into around 2018.

I would also consider using a comparison chart of all sectors to pinpoint what has happened and verify that this picture is relatively on track and perhaps pinpoint the beginning of a rotation. The sector rotation also provides a broad long term context, the seasonals provide a guideline for entry during that "context" and the technicals can help you pin point a more ideal buy point.

Then you can use individual fundamentals and technicals to decide what specifically to buy, or else just look at an ETF. If you are using an ETF, I believe you have an advantage in "rebalancing" since you can use that strategy to add lower, and effectively even change allocations to increase exposure slightly as you go lower. I would never do that with individual stocks, however, I may ADD a position or take a position off if I had a basket of a few in that sector, particularly if I made option plays. There are always multiple "fundamentals" and "technicals", so you gotta find what works for you.

You may not follow this "just because", but should perhaps tend to lean towards decisions that align with this. So perhaps you really don't like Industrials, so you just stay away or avoid going short, or if you have a slight dislike for them, have a much smaller position.

They say the market is near a top.

I hear people saying they are somehow a "contrarian" by selling here because they are starting to just hear friend and families are interested. But this can't be a top, there isn't any volume. I find it hard to believe that "everyone" is buying stocks when the amount of capital simply has not concentrated into stocks with nearly the same velocity as past bubbles. But those sentiment and bubble cycles happen on various timeframes, and certainly there was a bit of "froth" to the upward trend channel in the dow, which we have now sold off and begun working off. ( I Do not think we are done with a "correction", but that's all I think this is. I think we bounce, then head lower, then the bear trap hits and then markets launch and the public gets in at the end).

I have said that I believed it is entirely possible for a brief and very sharp correction around the world. I would expect it into September and October especially and of course it's ongoing in August. That will completely change the sentiment again on the short term cycle, and on the long term continue to fuel the "stocks are a casino" belief. ONE more REALLY GOOD shakeout I think before we break 16,000 in the dow and hit the long term "media attention".

I actually prefer the sentiment chart here:

But as to a typical "bubble", this is nothing of the sort, Bubbles break through their long term resistance and go parabolic, putting in yearly gains in a single month or two as they peak, with a near double coming in a year or less. The dow took 4.5 years to go from around 8,000 to short of 16,000. The nasdaq first from 1995-1998 to double from 1,000, and then still put in 2.5 times that. The Nikkei went from 6000 to 12000 from 1980-1984 or so and then went to 25,000 in 1987, pulled back to close to 20,000 and from the low around 1988 to 1989 it nearly doubled running to +38k again. "You ain't seen nothing yet" if this is to be a bubble. Look at even the post 1987 crash low for the next 13 years. Dow went up 7.27 times that level. That would take us to +47000 by 2022, and the DOW wasn't even the "bubble" market during that time frame. The Nasdaq '87 low went from 288.5 to 5048.62 or 17.5 times the low. That would put dow above 100k by 2022. That would be ridiculous for a "non growth stock", but Whether it's a Nikkei run, or a dow run, the possibility of a secular run is ridiculously high to the upside. The long term bias must be to the upside because stocks can go up 100s of percent if not pushing 1000% (the famous "10-bagger" as it's called), and they can only go down 100%. Of course if your ACCOUNT is down 100%, you can never get back to even, and if it is down 90% you need the 1000% return to get back to even. So of course cash is still important, but the probability of it going down even remotely close to that is extremely slim, and the odds and return are BOTH to the upside.

We may have had "aversion" but I don't think so. The 2011 debt ceiling/credit downgrade certainly took us to "aversion" or even "panic" type of levels, but only on shorter time frames. I think there still could be one more good move downwards as the budget battle commences, but perhaps we are just in the early phases of "denial" and the correction never even amounts to a 10% correction.

I think 10% would be healthy, but we don't necessarily need it to set the stage for a tremendous run higher. Use the opportunity to identify stocks on sale. If you are an option buyer, you may want to take a small amount of your portfolio and look to bet on a MAJOR move with far OTM options expiring in 2015 (and possibly rolling them into 2016 when you get the opportunity). If you aren't, you may stil lconsider leveraged ETFs such as TNA or UDOW. I also like aiming for those near the top of the cycle such as Basic Materials (MATL,UYM) and Energy (ERX,DIG) and concentrating a bit more in those areas.

This is the opportunity you must take advantage of while you can.

I have said that I believed it is entirely possible for a brief and very sharp correction around the world. I would expect it into September and October especially and of course it's ongoing in August. That will completely change the sentiment again on the short term cycle, and on the long term continue to fuel the "stocks are a casino" belief. ONE more REALLY GOOD shakeout I think before we break 16,000 in the dow and hit the long term "media attention".

I actually prefer the sentiment chart here:

But as to a typical "bubble", this is nothing of the sort, Bubbles break through their long term resistance and go parabolic, putting in yearly gains in a single month or two as they peak, with a near double coming in a year or less. The dow took 4.5 years to go from around 8,000 to short of 16,000. The nasdaq first from 1995-1998 to double from 1,000, and then still put in 2.5 times that. The Nikkei went from 6000 to 12000 from 1980-1984 or so and then went to 25,000 in 1987, pulled back to close to 20,000 and from the low around 1988 to 1989 it nearly doubled running to +38k again. "You ain't seen nothing yet" if this is to be a bubble. Look at even the post 1987 crash low for the next 13 years. Dow went up 7.27 times that level. That would take us to +47000 by 2022, and the DOW wasn't even the "bubble" market during that time frame. The Nasdaq '87 low went from 288.5 to 5048.62 or 17.5 times the low. That would put dow above 100k by 2022. That would be ridiculous for a "non growth stock", but Whether it's a Nikkei run, or a dow run, the possibility of a secular run is ridiculously high to the upside. The long term bias must be to the upside because stocks can go up 100s of percent if not pushing 1000% (the famous "10-bagger" as it's called), and they can only go down 100%. Of course if your ACCOUNT is down 100%, you can never get back to even, and if it is down 90% you need the 1000% return to get back to even. So of course cash is still important, but the probability of it going down even remotely close to that is extremely slim, and the odds and return are BOTH to the upside.

We may have had "aversion" but I don't think so. The 2011 debt ceiling/credit downgrade certainly took us to "aversion" or even "panic" type of levels, but only on shorter time frames. I think there still could be one more good move downwards as the budget battle commences, but perhaps we are just in the early phases of "denial" and the correction never even amounts to a 10% correction.

I think 10% would be healthy, but we don't necessarily need it to set the stage for a tremendous run higher. Use the opportunity to identify stocks on sale. If you are an option buyer, you may want to take a small amount of your portfolio and look to bet on a MAJOR move with far OTM options expiring in 2015 (and possibly rolling them into 2016 when you get the opportunity). If you aren't, you may stil lconsider leveraged ETFs such as TNA or UDOW. I also like aiming for those near the top of the cycle such as Basic Materials (MATL,UYM) and Energy (ERX,DIG) and concentrating a bit more in those areas.

This is the opportunity you must take advantage of while you can.

Monday, August 5, 2013

target 40,000?

Every now and then when I get the feeling we may be at extremes I

like to check to see if there is any past behavior in the market that

can give us a clue. Human nature remains very much the same even as

power, leverage and credit shifts, that too is governed by human nature.

Charts really are only available since the 1900s so 110 years worth of

data perhaps doesn't really capture the rise and fall of entire nations

and how that effects the economy and trade and the growth of technology

is a wildcard as well.

Still though, that's a long time to look for patterns and we should be able to find some time frame in which we recovered from a major low and are years into the recovery. Of all those periods, we should be able to find one that lines up well.

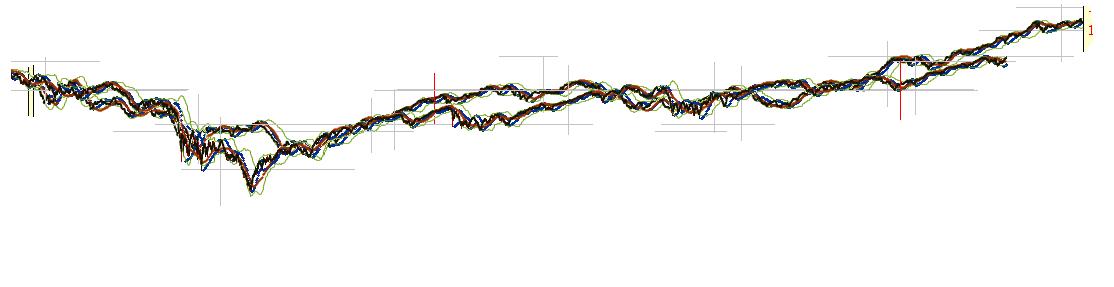

While there seemed to be several periods of time that lined up fairly well, there are really 2 candidates that I really liked that came off a major bottom. Unfortunately they are polar opposites. The one was 2002-2007. But the one that I think will shock some people is the period of

1920-1926

The last time I saw an analog line up like this was in 2009 near the bottom. We rallied from the low the expected 60% but actually kept going. Analogs only work so long.

I blogged about this way back. In fact, to access it we have to use the "way back" machine.

http://web.archive.org/web/20090108182333/http://www.ibankcoin.com/peanut_gallery/index.php/2008/11/17/historical-comparisons-part-1-now-vs-1929

Back then it was "now vs 1929" where 2007 lined up with 1929 top basically. Now it's now vs 1929 where mid way through 2015 or late 2015 lines up with 1929.

If this actually works going forward it is suggesting a huge bullish move as took place between 1927-1929. During that period, stocks went up around 150% depending on where you measure from exactly.

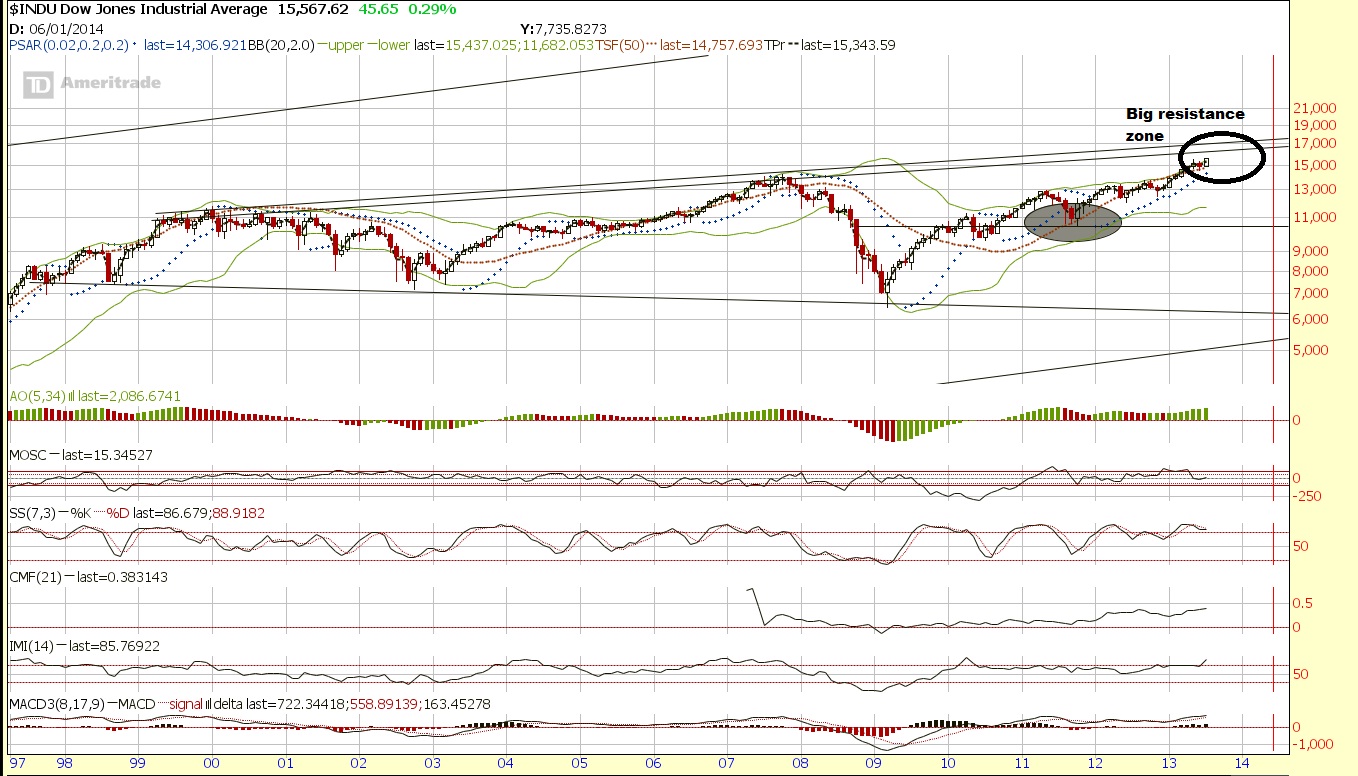

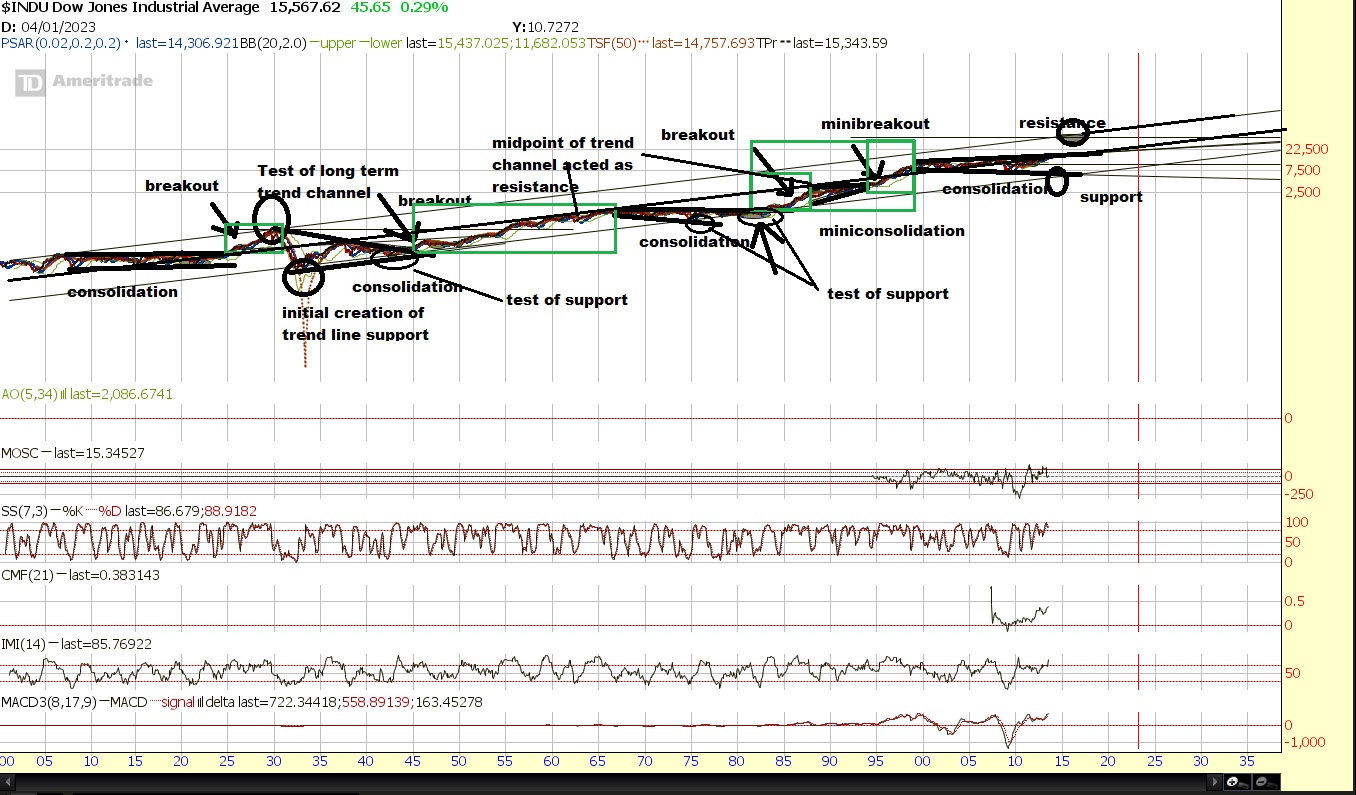

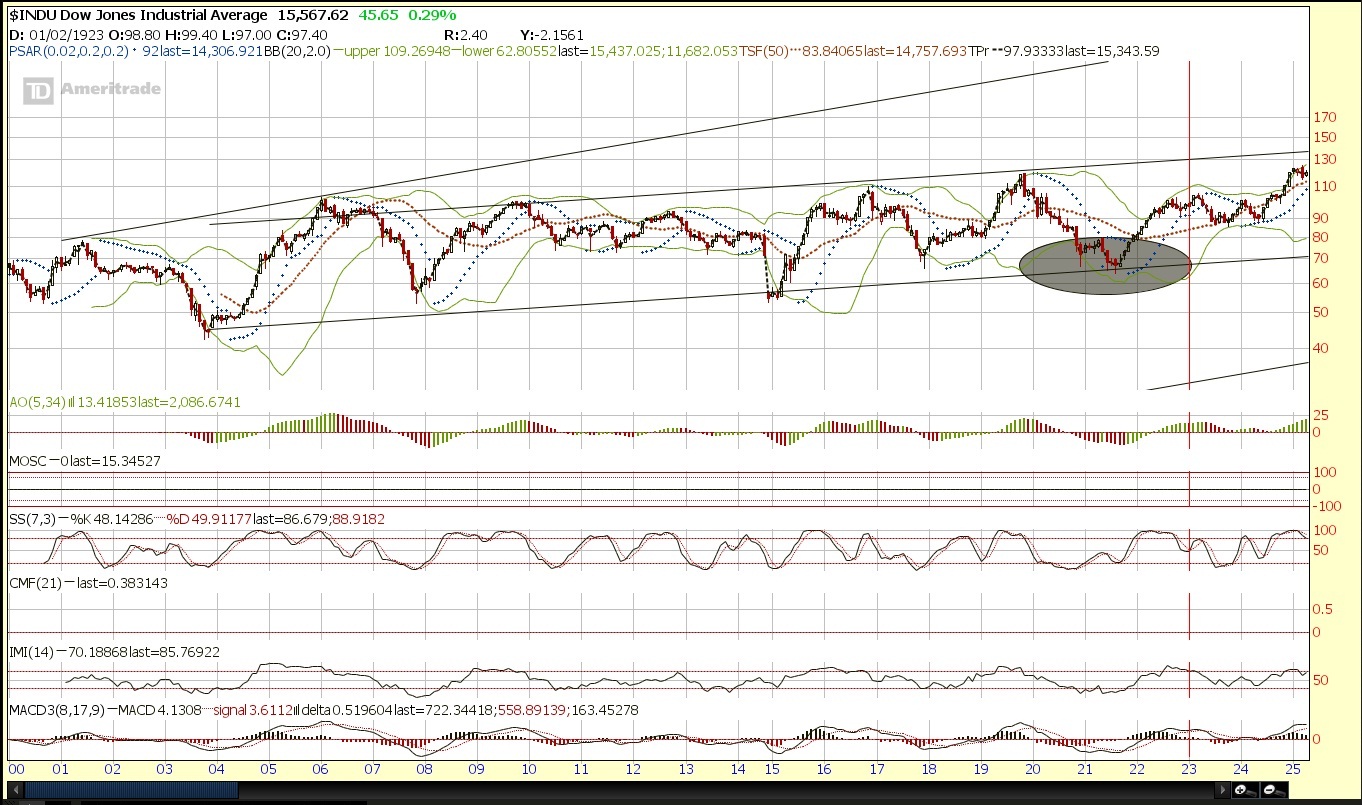

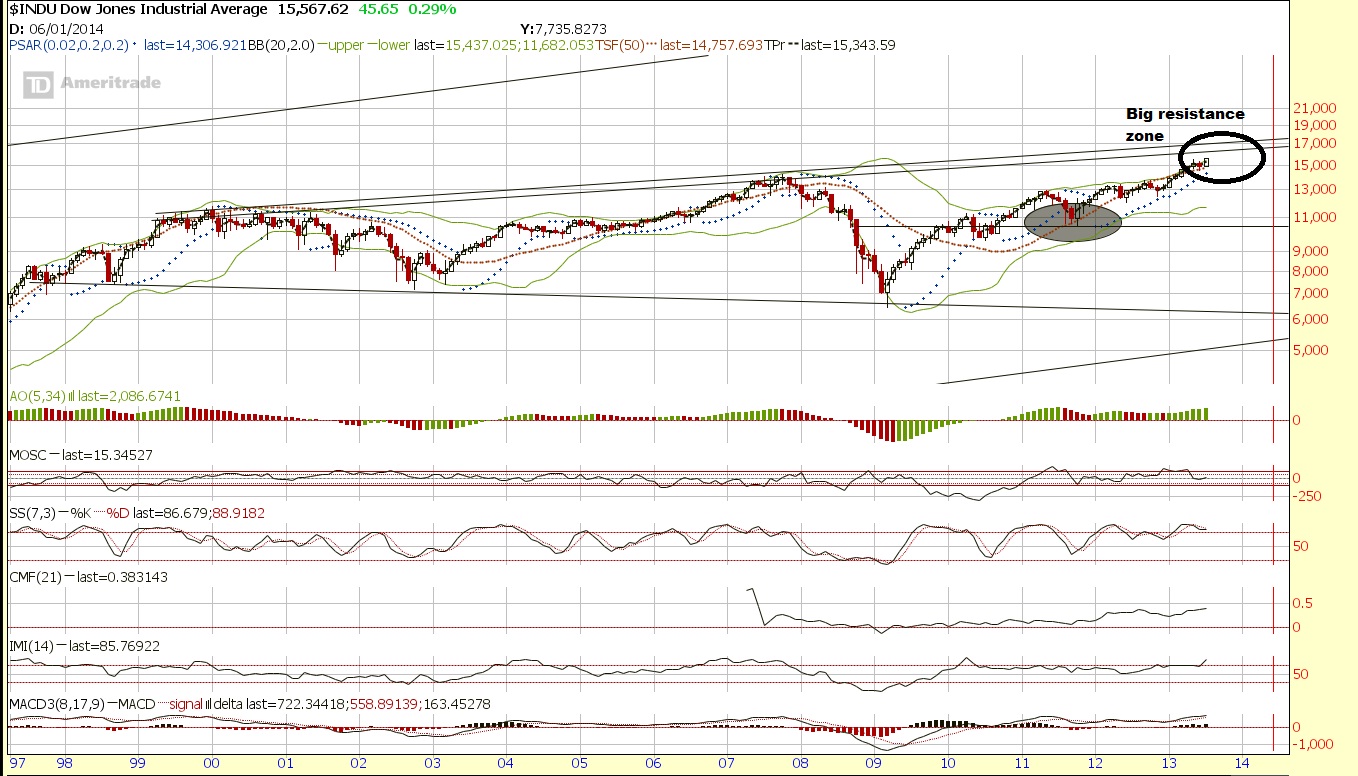

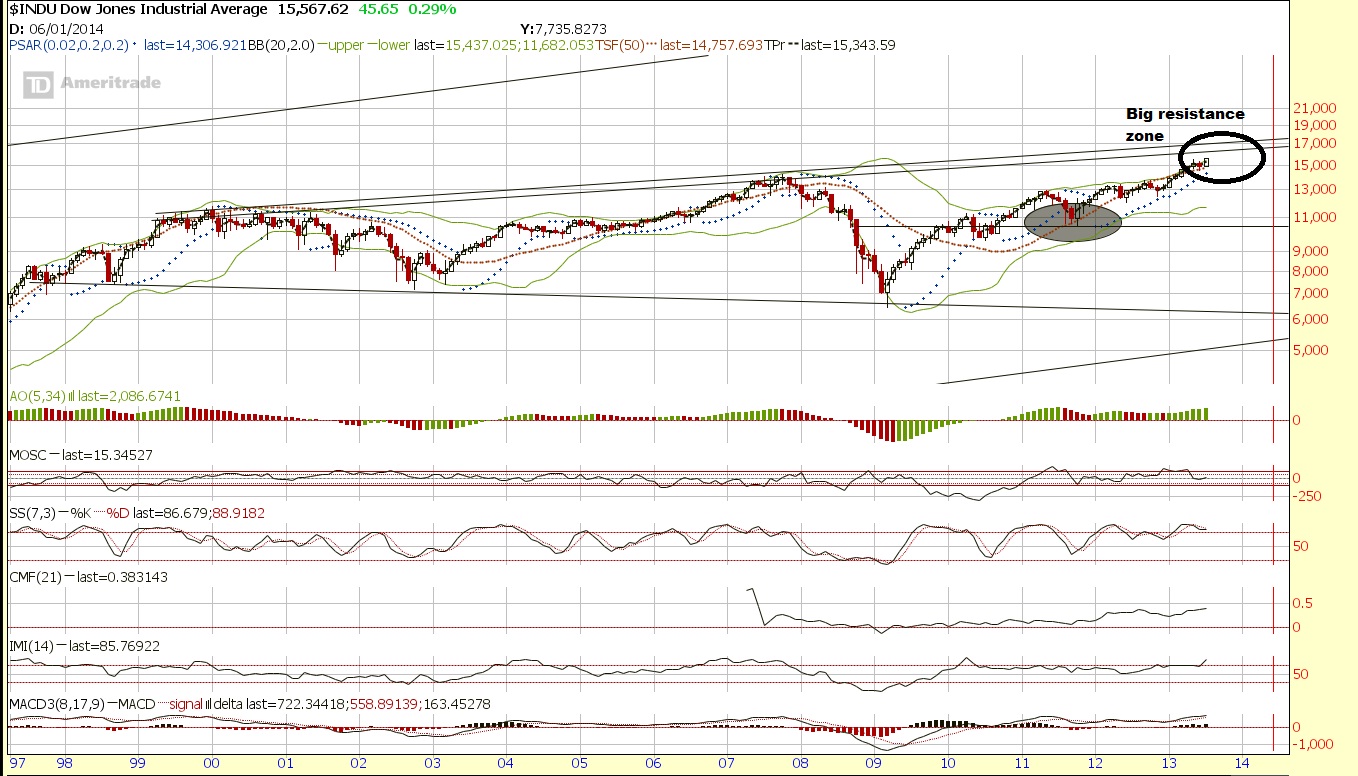

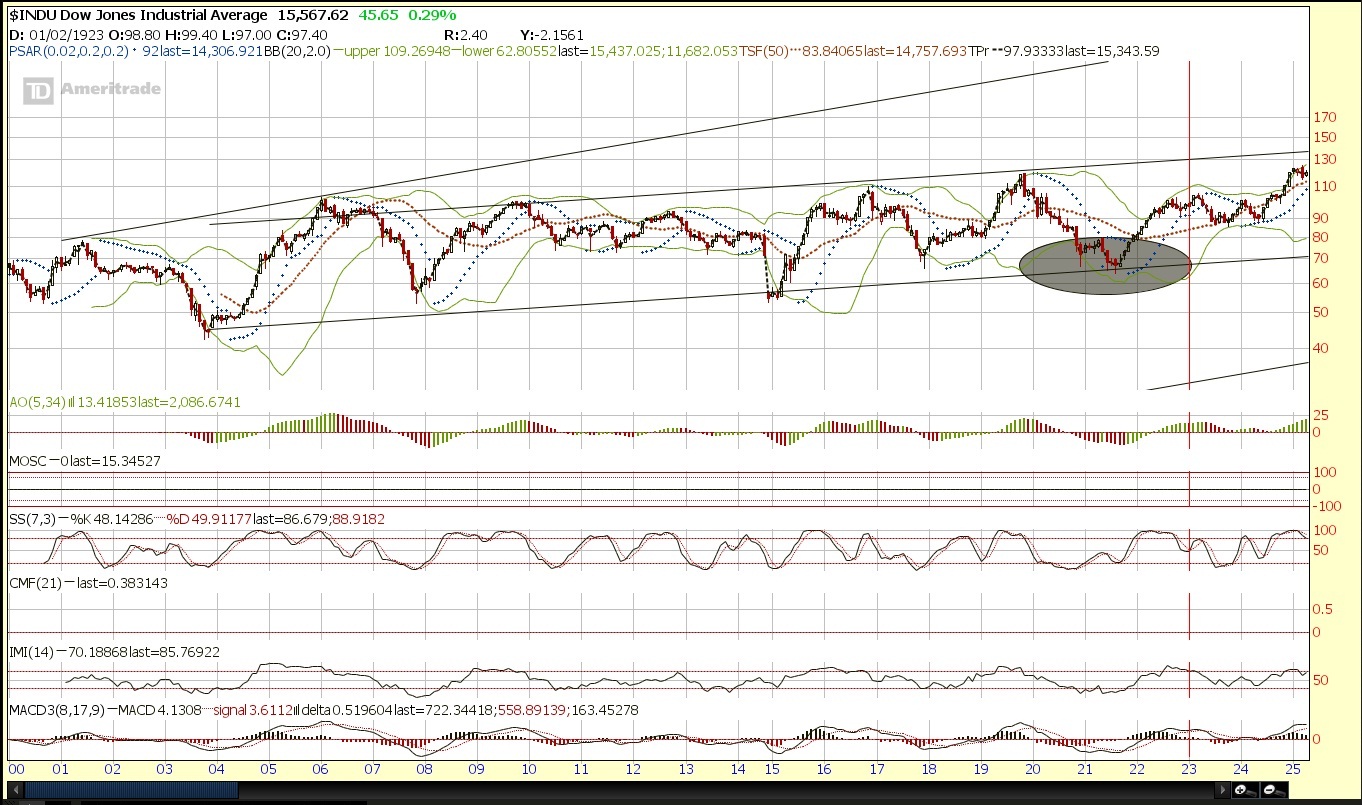

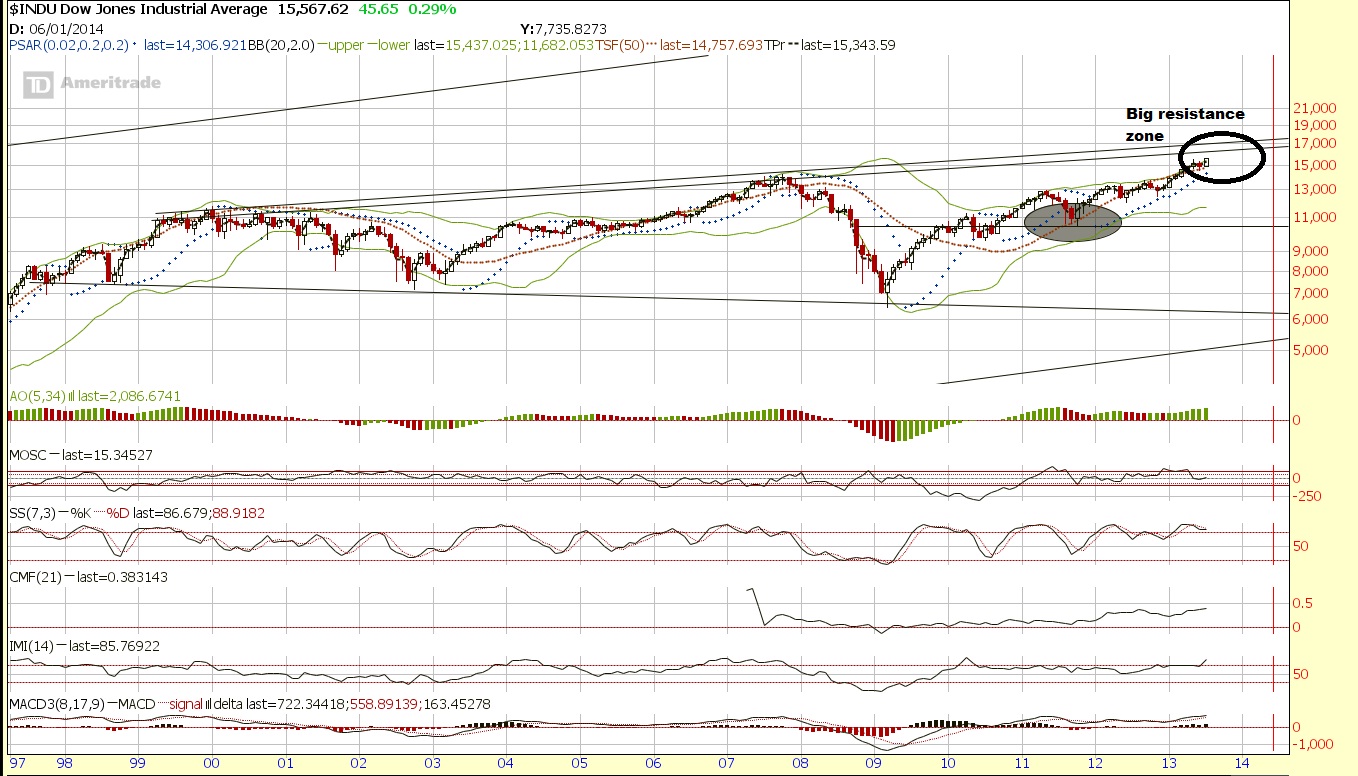

There are other ways to look at potential targets. However the big issue we still have to overcome is the long term trendline of the dow which puts resistance around the general range of 16,000.

There is support around 13,000 and then 10,500 and then again at 7500 and very, very long term support at 6000 or so. The resistance kicks in around 16,000. After that? There is really no reference until around 40,000.

Ideally, we will get a sharp crash like similar to 1987, and perhaps an even greater crash in other parts of the world, which could set the stage for a monster parabolic run. Although the opposite side of that perhaps would not be so healthy.

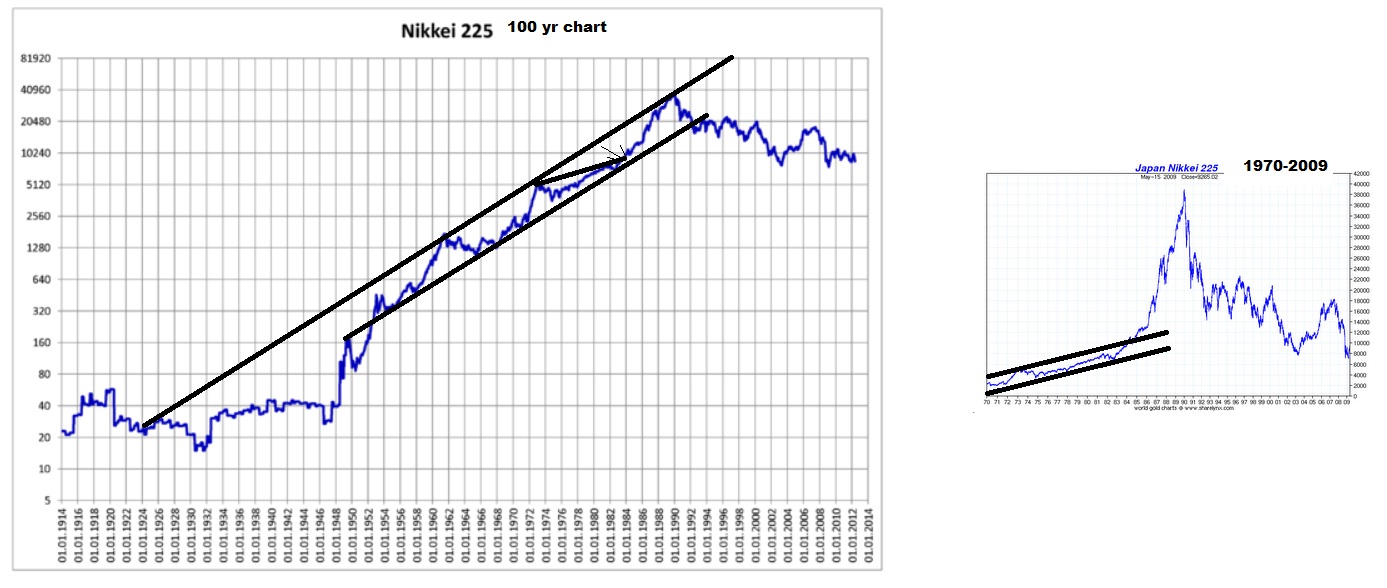

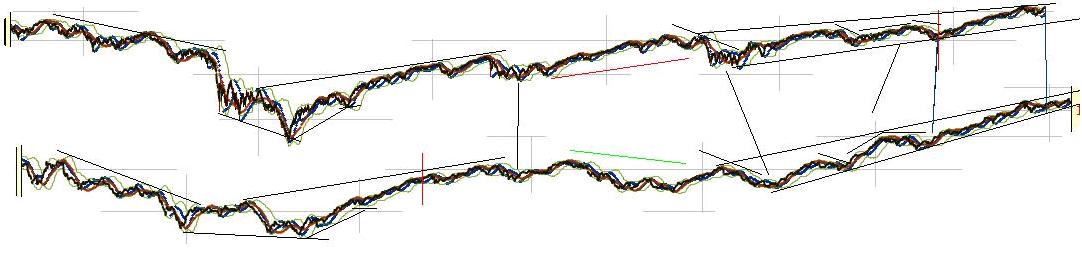

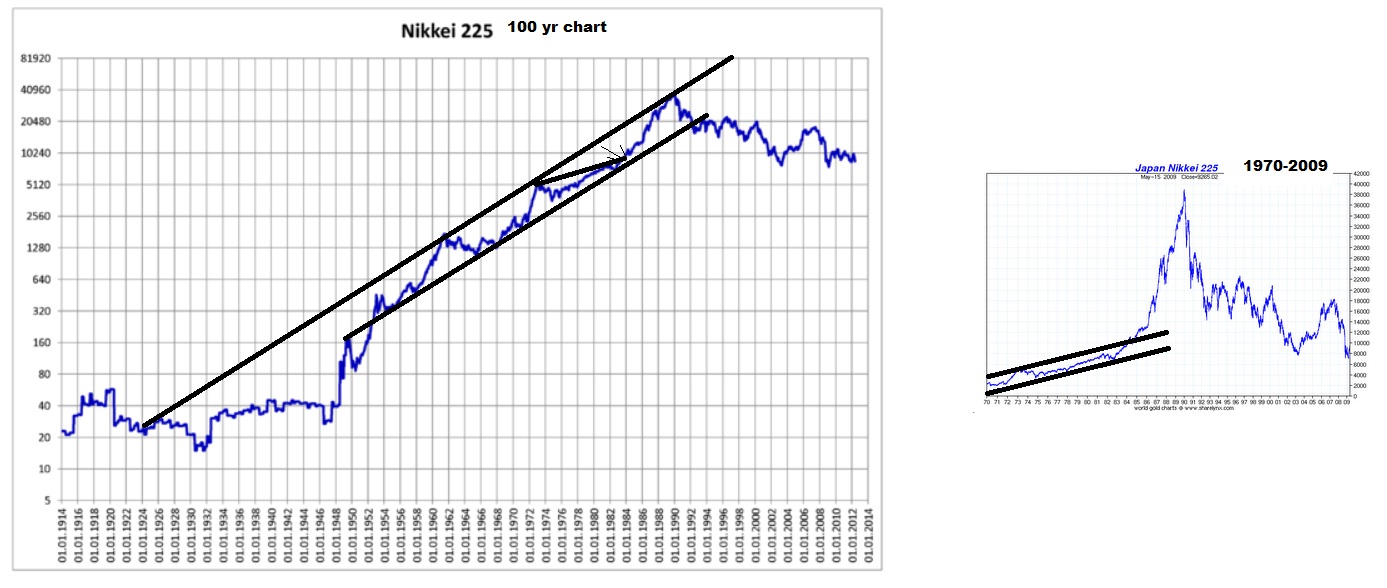

Here is japan

You probably more often see the chart on the right dating back from 1970 leading to 1989. But look at the chart on the left that truely offers a long enough historical comparison for us to see that 1989 could really just be perceived as a test of very long term resistance on a trend-line.

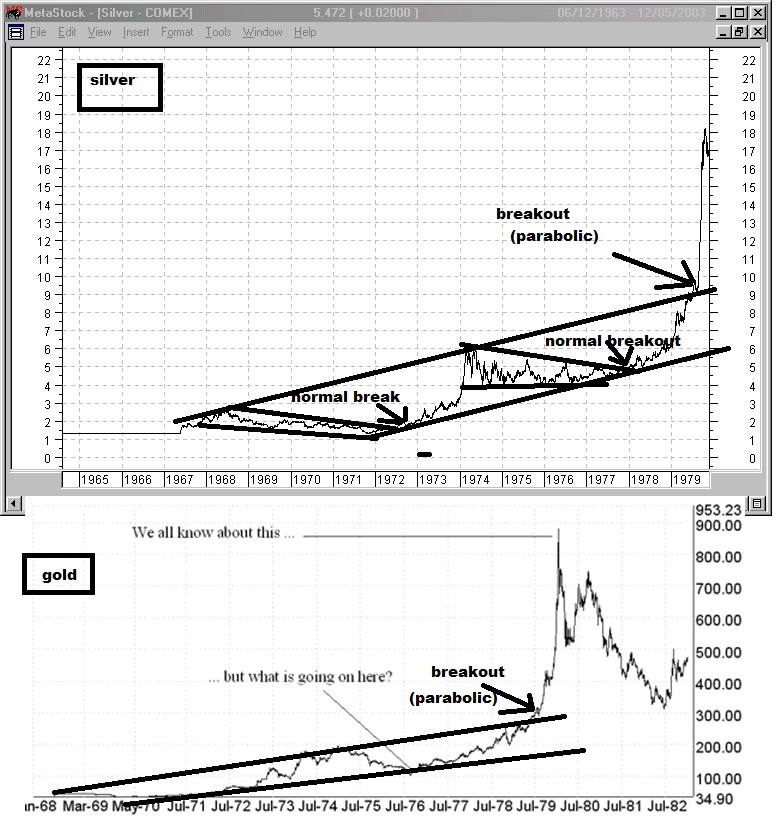

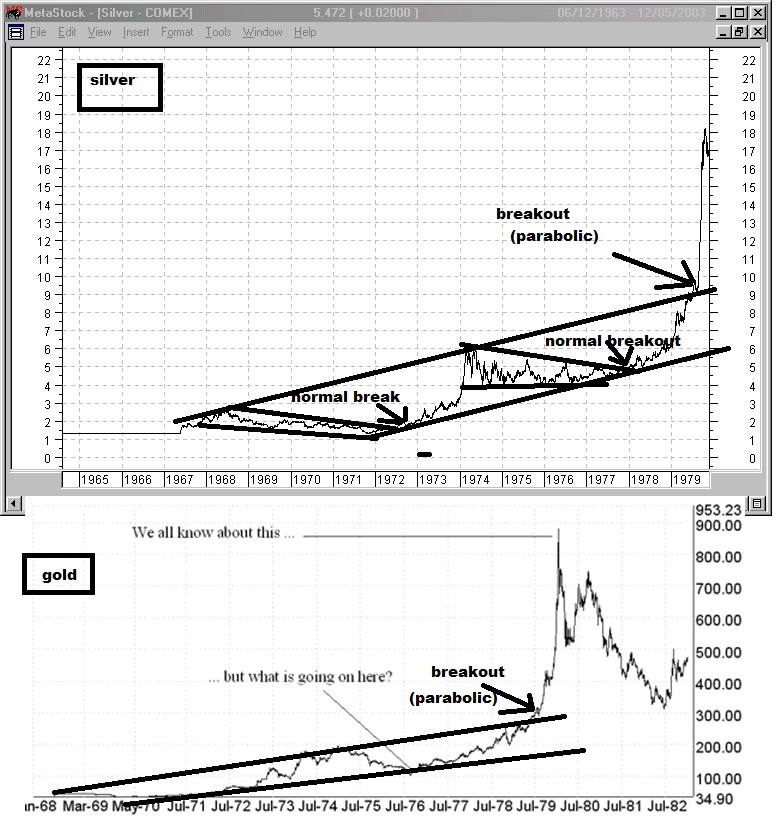

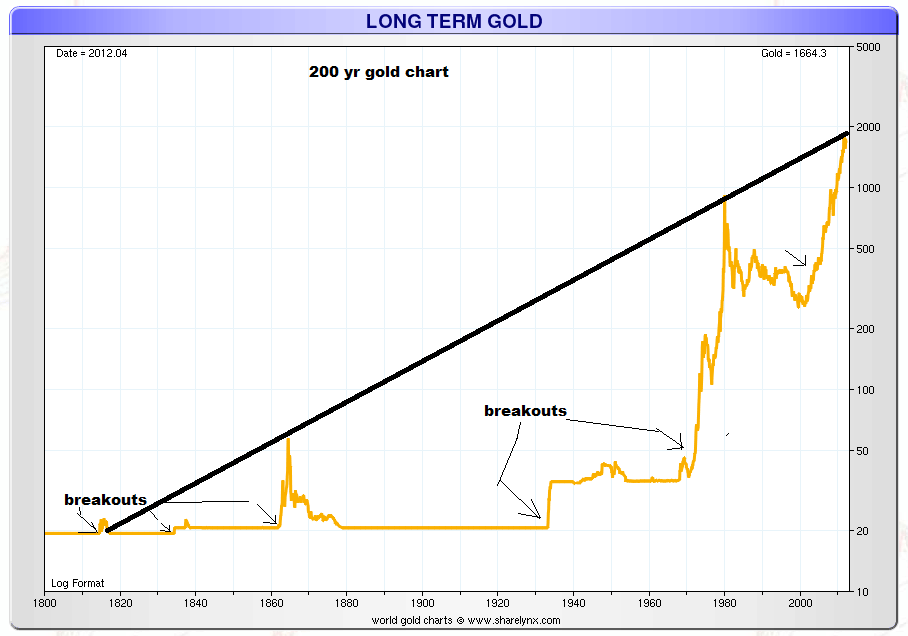

Here is another market. First the chart you are probably used to seeing.

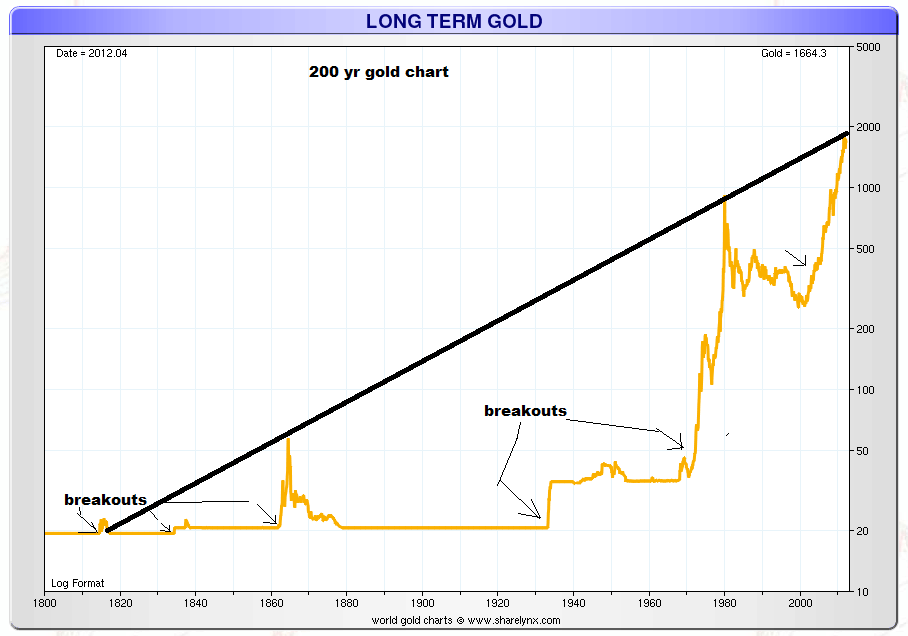

Next, a much greater historical context of data.

So gold at 1900 actually was actually just a test of resistance. I think the data derived from understanding the total global "allocation" weighting towards each asset class at a given time and factoring in supply would be much better to measure with regards to bubbles to know just how extreme these moves get by asset class. Bubble's "end" when either the credit can no longer expand at the same rate or the allocation weighting cannot shift anymore aggressively towards that asset without completely neglecting and providing ridiculous valuations and opportunity elsewhere. The bubble peaks when buying power cannot sustain the prices and the slightest amount of selling pressure and all the volume that came in towards the end buying "at any price" suddenly end up underwater and want to sell. Everyone who wants to buy already has done so and the price can go nowhere else but down.

But nature of bubble's aside, All asset classes can act like that since price is a function of confidence and perception of return relative to all other opportunities.

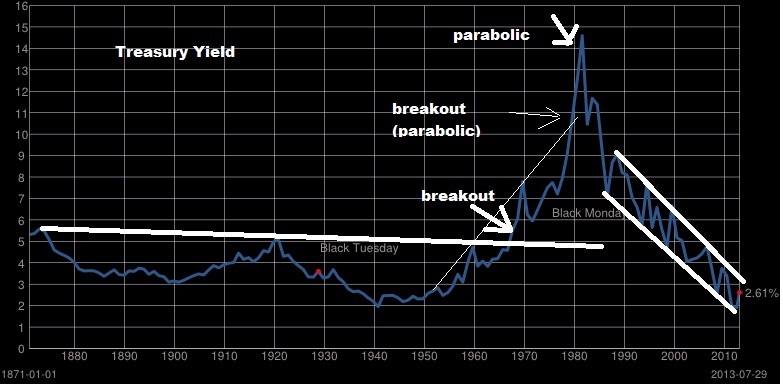

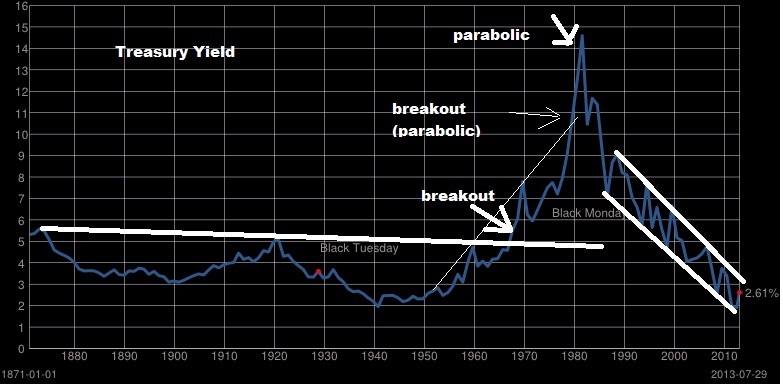

Yields went parabolic even. But the time in which yields went parabolic at the end was measured in decades, rather than years. The time frame of such a cycle is much different than stocks or gold.

We have three great examples of stocks going parabolic. The roaring 20s, the Nikkei bubble into 1989, and the nasdaq bubble into 2000.

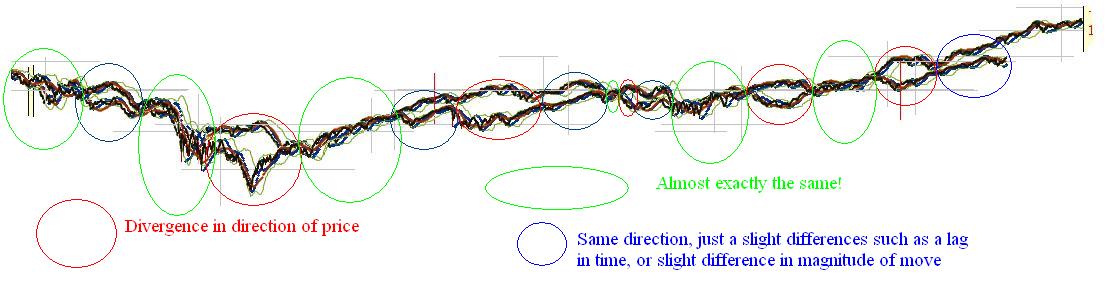

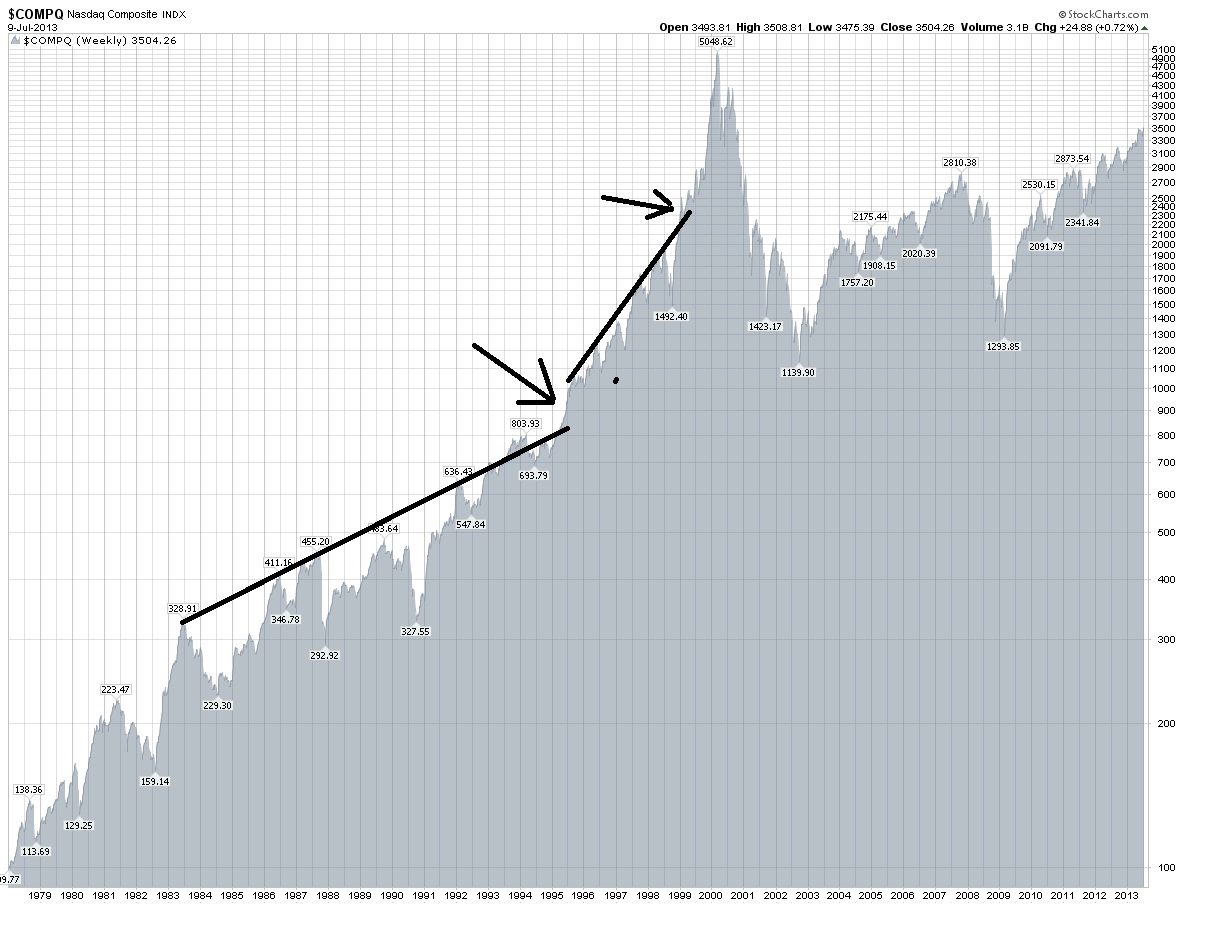

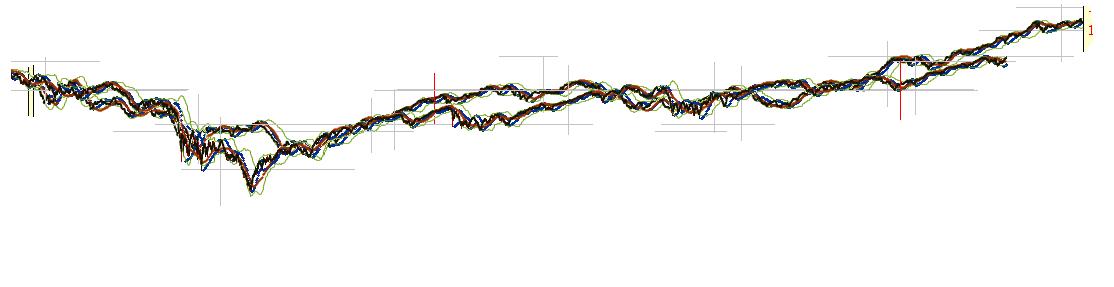

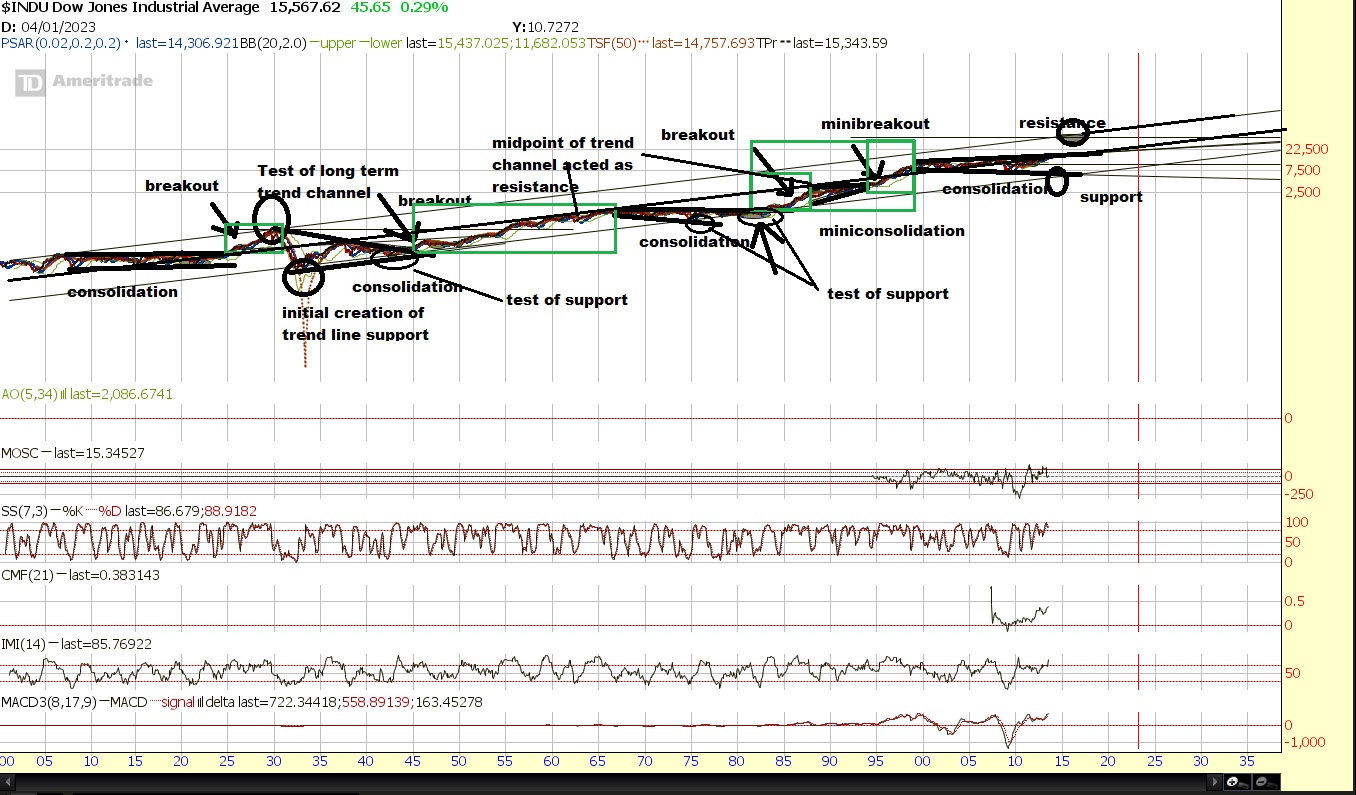

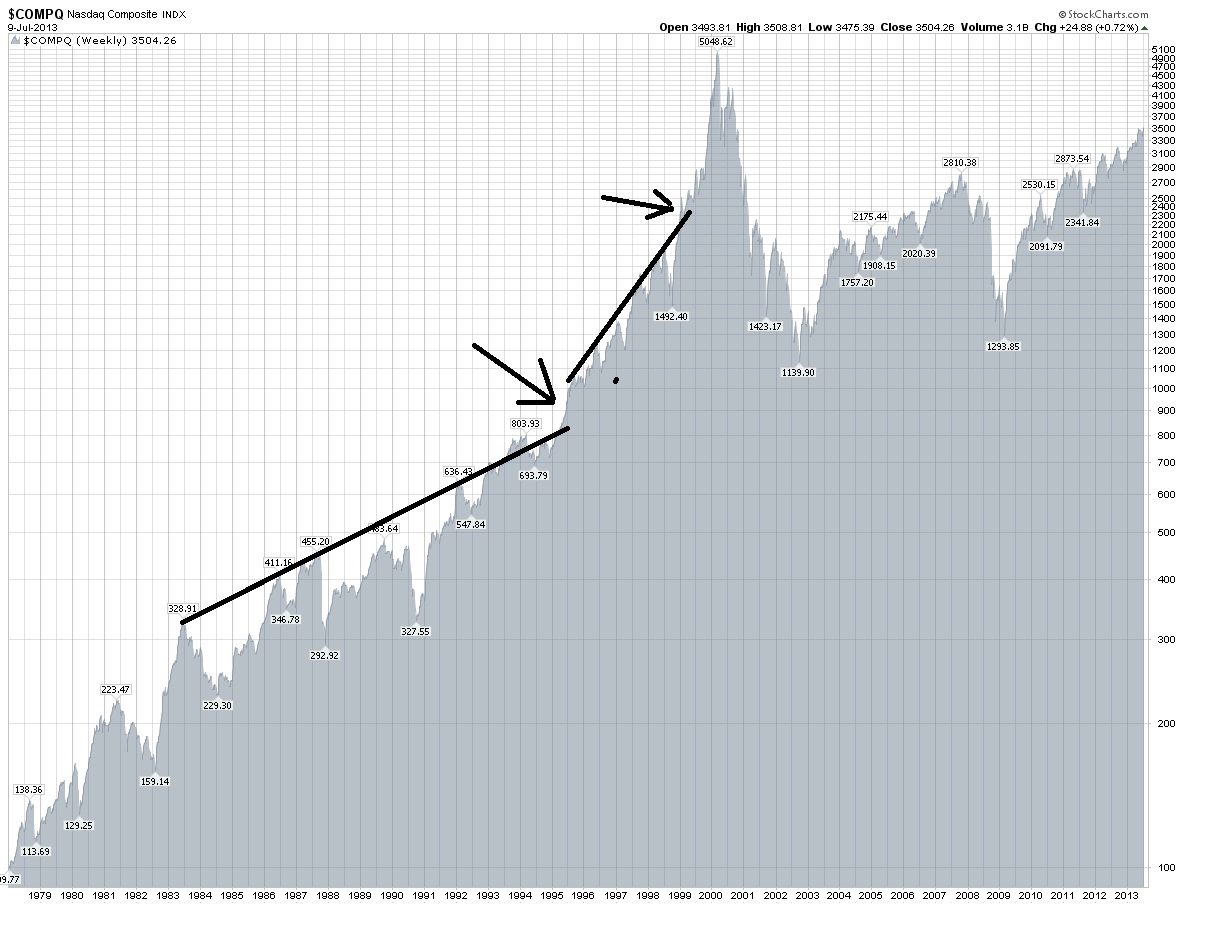

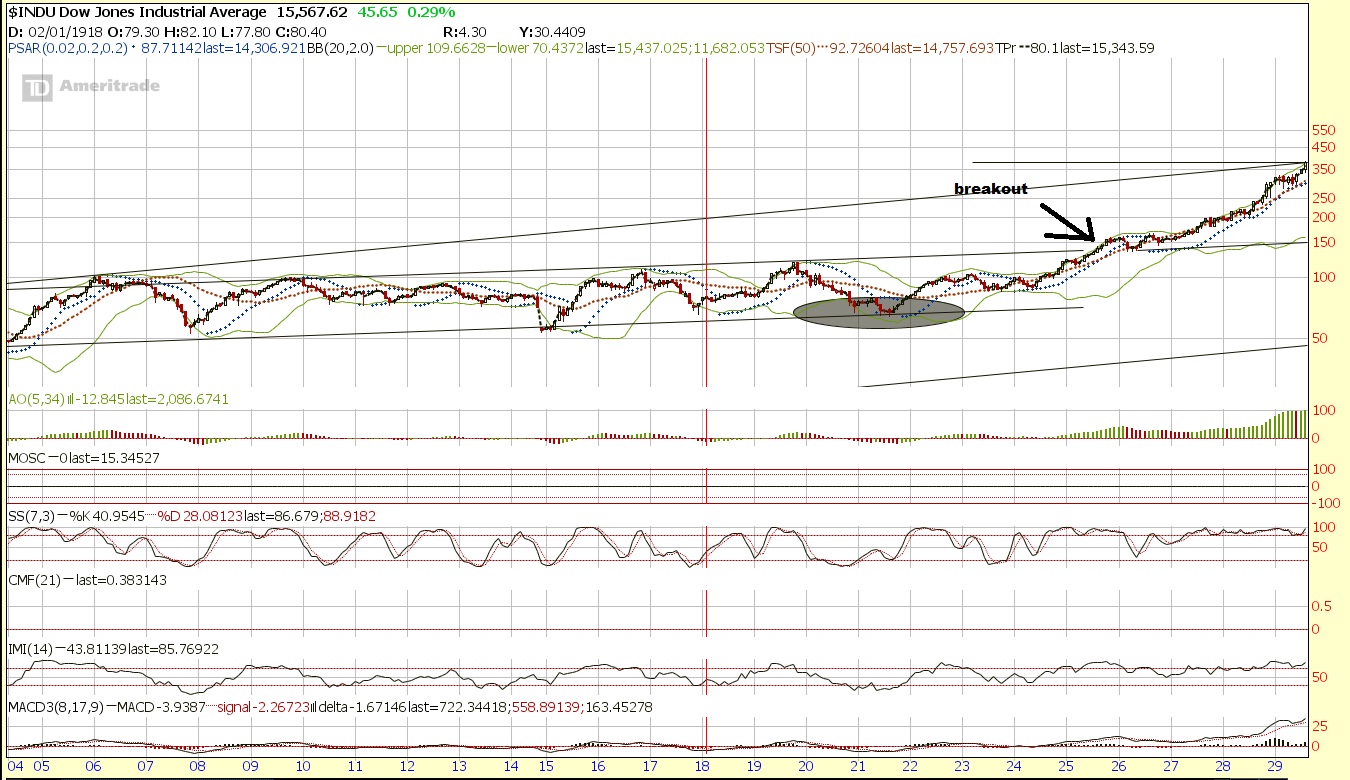

ou can see

You can see that as a trendline is broken, and it doubles, if during that double it breaks another trendline, the time in which it doubles is significantly less. Actually the move into 1984 was a slight break of the previous trend and after the pullback it basically doubled from 300 to 600 in 8 years first. Then 800 in 1994 to 1600 in 1998 4 years. Then 1999 to 2000 from under 2500 to over 5000 in 1 and a half years.

When the major break of the trendline is made, the asset often accelerates to it's peak. In the extreme example like the Nikkei or nasdaq we see it double and then double again.

Perhaps if/when we break the long term resistance it will instead be a "secular" run. Afterall, as I have shown, the returns are possible to continue measured over a long period of time. I am not yet convinced we won't see a significant pullback first, and we are coming up on the period of time August-October that worries me.

However, the actual very long term resistance probably will still hold, so it's a question of whether we set up a quick run to extreme historical highs (1929), or a gradual run to large gains over decades (1942-1965, 1982-2000). You could measure from trough to peak, or you could measure from the distance after the breakouts. I have done this in historical look from 1900-2013.

From “breakout” point (This has YET to happen)

1924-1929 104 to 386.1 A 271.25% Gain

1951-1966 235 to 1001.1 A 326% Gain

1983 to 2000 1100 to 11750.25 A 968.20% Gain

(ALTERNATE: 1983 to 1987 1100 to 2746.70 A 149.70% Gain)

(1995 to 2000 4000 to 11750.25 A 193.76% Gain)

You can add onto that the parabolic runs of the nasdaq, and the nikkei with minor considerations and even look at a few of gold's historic runs to get an even more bullish target.

I think ultimately if you think the market is going "parabolic" the very long term upper trend channel that I outlined is the target, which is around 40,000. I think history shows that if you break the long term trend channel, you can see stocks double in only a few years such as in the nasdaq or Nikkei's final run up. Actually, in both cases they basically quadrupled in around 4 years.

Then there is the dow in the roaring 20s. Before it broke the long term resistance lets see what it looked like first.

Compare that to the dow right now.

and now afterwards what did the roaring 20s look like?

It put in about a 150% gain in 4 years. Where does 150% gain from the breakout point of around 16000 take us? You got it, 40,000.

Let's look at other famous bubbles just for fun...

http://myweb.rollins.edu/jsiry/south-seas-bubble.jpg

http://timiacono.com/wp-content/uploads/11-01-27_newton.png

http://www.thebubblebubble.com/wp-content/uploads/2012/06/mississippi-stock-chart.jpg

http://origin-ars.els-cdn.com/content/image/1-s2.0-S0304405X12002541-gr1.jpg

The money exists in the system to take us there too. Just look at some numbers.

backup images

So Resistance is 40,000 long term and we could easily hit that. The nasdaq type of run could take us there too.

Still though, that's a long time to look for patterns and we should be able to find some time frame in which we recovered from a major low and are years into the recovery. Of all those periods, we should be able to find one that lines up well.

While there seemed to be several periods of time that lined up fairly well, there are really 2 candidates that I really liked that came off a major bottom. Unfortunately they are polar opposites. The one was 2002-2007. But the one that I think will shock some people is the period of

1920-1926

The last time I saw an analog line up like this was in 2009 near the bottom. We rallied from the low the expected 60% but actually kept going. Analogs only work so long.

I blogged about this way back. In fact, to access it we have to use the "way back" machine.

http://web.archive.org/web/20090108182333/http://www.ibankcoin.com/peanut_gallery/index.php/2008/11/17/historical-comparisons-part-1-now-vs-1929

Back then it was "now vs 1929" where 2007 lined up with 1929 top basically. Now it's now vs 1929 where mid way through 2015 or late 2015 lines up with 1929.

If this actually works going forward it is suggesting a huge bullish move as took place between 1927-1929. During that period, stocks went up around 150% depending on where you measure from exactly.

There are other ways to look at potential targets. However the big issue we still have to overcome is the long term trendline of the dow which puts resistance around the general range of 16,000.

There is support around 13,000 and then 10,500 and then again at 7500 and very, very long term support at 6000 or so. The resistance kicks in around 16,000. After that? There is really no reference until around 40,000.

Ideally, we will get a sharp crash like similar to 1987, and perhaps an even greater crash in other parts of the world, which could set the stage for a monster parabolic run. Although the opposite side of that perhaps would not be so healthy.

Here is japan

You probably more often see the chart on the right dating back from 1970 leading to 1989. But look at the chart on the left that truely offers a long enough historical comparison for us to see that 1989 could really just be perceived as a test of very long term resistance on a trend-line.

Here is another market. First the chart you are probably used to seeing.

Next, a much greater historical context of data.

So gold at 1900 actually was actually just a test of resistance. I think the data derived from understanding the total global "allocation" weighting towards each asset class at a given time and factoring in supply would be much better to measure with regards to bubbles to know just how extreme these moves get by asset class. Bubble's "end" when either the credit can no longer expand at the same rate or the allocation weighting cannot shift anymore aggressively towards that asset without completely neglecting and providing ridiculous valuations and opportunity elsewhere. The bubble peaks when buying power cannot sustain the prices and the slightest amount of selling pressure and all the volume that came in towards the end buying "at any price" suddenly end up underwater and want to sell. Everyone who wants to buy already has done so and the price can go nowhere else but down.

But nature of bubble's aside, All asset classes can act like that since price is a function of confidence and perception of return relative to all other opportunities.

Yields went parabolic even. But the time in which yields went parabolic at the end was measured in decades, rather than years. The time frame of such a cycle is much different than stocks or gold.

We have three great examples of stocks going parabolic. The roaring 20s, the Nikkei bubble into 1989, and the nasdaq bubble into 2000.

ou can see

You can see that as a trendline is broken, and it doubles, if during that double it breaks another trendline, the time in which it doubles is significantly less. Actually the move into 1984 was a slight break of the previous trend and after the pullback it basically doubled from 300 to 600 in 8 years first. Then 800 in 1994 to 1600 in 1998 4 years. Then 1999 to 2000 from under 2500 to over 5000 in 1 and a half years.

When the major break of the trendline is made, the asset often accelerates to it's peak. In the extreme example like the Nikkei or nasdaq we see it double and then double again.

Perhaps if/when we break the long term resistance it will instead be a "secular" run. Afterall, as I have shown, the returns are possible to continue measured over a long period of time. I am not yet convinced we won't see a significant pullback first, and we are coming up on the period of time August-October that worries me.

However, the actual very long term resistance probably will still hold, so it's a question of whether we set up a quick run to extreme historical highs (1929), or a gradual run to large gains over decades (1942-1965, 1982-2000). You could measure from trough to peak, or you could measure from the distance after the breakouts. I have done this in historical look from 1900-2013.

From “breakout” point (This has YET to happen)

1924-1929 104 to 386.1 A 271.25% Gain

1951-1966 235 to 1001.1 A 326% Gain

1983 to 2000 1100 to 11750.25 A 968.20% Gain

(ALTERNATE: 1983 to 1987 1100 to 2746.70 A 149.70% Gain)

(1995 to 2000 4000 to 11750.25 A 193.76% Gain)

You can add onto that the parabolic runs of the nasdaq, and the nikkei with minor considerations and even look at a few of gold's historic runs to get an even more bullish target.

I think ultimately if you think the market is going "parabolic" the very long term upper trend channel that I outlined is the target, which is around 40,000. I think history shows that if you break the long term trend channel, you can see stocks double in only a few years such as in the nasdaq or Nikkei's final run up. Actually, in both cases they basically quadrupled in around 4 years.

Then there is the dow in the roaring 20s. Before it broke the long term resistance lets see what it looked like first.

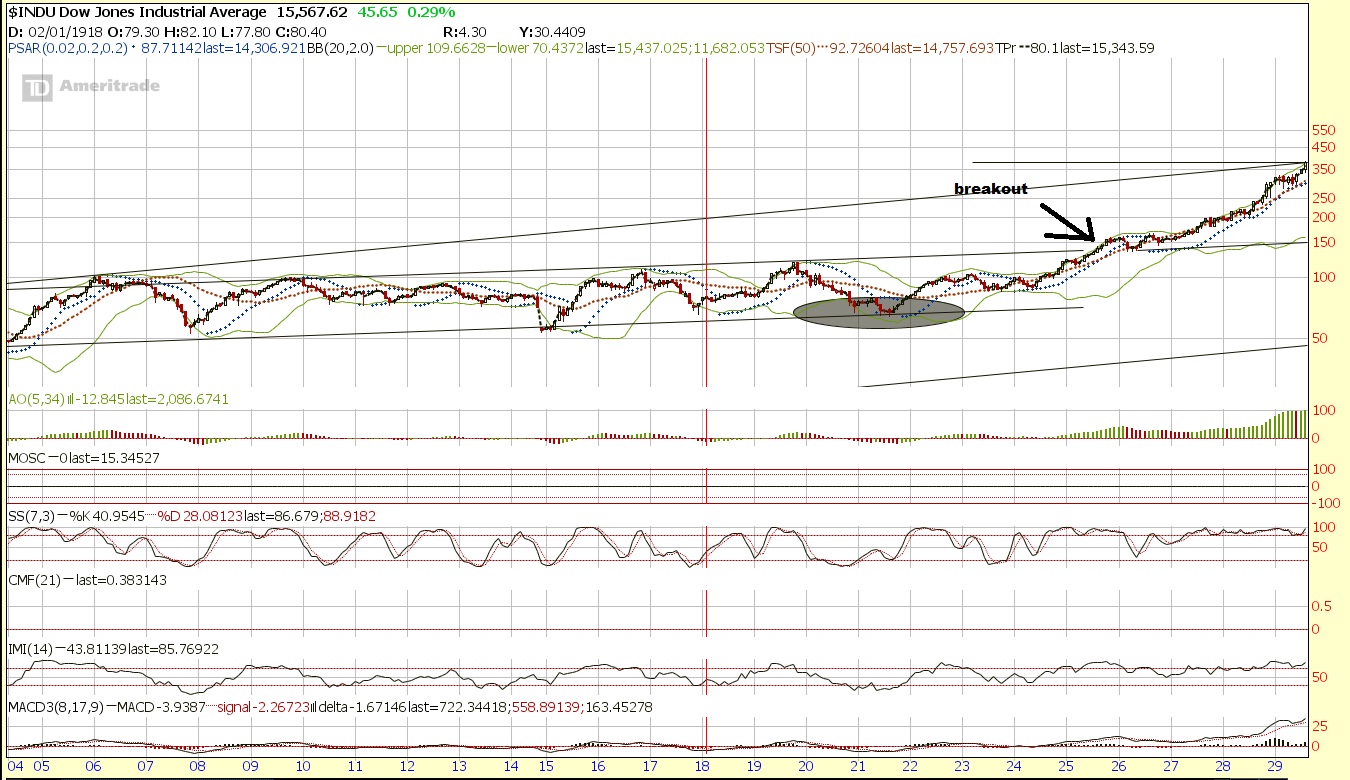

Compare that to the dow right now.

and now afterwards what did the roaring 20s look like?

It put in about a 150% gain in 4 years. Where does 150% gain from the breakout point of around 16000 take us? You got it, 40,000.

Let's look at other famous bubbles just for fun...

http://myweb.rollins.edu/jsiry/south-seas-bubble.jpg

http://timiacono.com/wp-content/uploads/11-01-27_newton.png

http://www.thebubblebubble.com/wp-content/uploads/2012/06/mississippi-stock-chart.jpg

http://origin-ars.els-cdn.com/content/image/1-s2.0-S0304405X12002541-gr1.jpg

The money exists in the system to take us there too. Just look at some numbers.

backup images

So Resistance is 40,000 long term and we could easily hit that. The nasdaq type of run could take us there too.

Thursday, August 1, 2013

Major Stock Market Opportunities:You May Only Get ONE Chance To Reap The Great Harvest

There are certain opportunities that don't come very often. First of all you have to be ready to recognize them and that means being thoroughly prepared. Secondly you have to NOT recognize false opportunities, which means not getting an okay or great opportunity ffrom a once in a lifetime one.

Then, when you get that opportunity, you have to take aggressive, decisive action.

The key may be preparing for such an action so it is possible BEFORE the event takes place. And perhaps plenty of foresight as you may not have very much time to prepare for the greatest opportunities.

When the opportunity finally is there you certainly will be tempted not to take action. After all, those capable of waiting and passing up opportunities for a greater one, or throwing other good opportunities aside ahead of time to prepare to take that bold decisive action often will find it hard to be both patient and aggressive.

But when you get those pocket aces, you have to be willing to go all in. When you finally get that perfect pitch, you have to swing for the fence. When you have an excellent business selling at a significant discount, you have to be ready to jump on it. When the market is breaking out, you have to aggressively get in. When the market is crashing to it's oversold bottom low, you have to recognize the deep value companies.

There is always opportunity, The question is how much and how great is the opportunity, and will you be in position to win from it?

And will you manage your risks the very large majority of the time so that you are still around and have a great bankroll when the moment comes? The majority miss out on the best opportunities and that is why they are forced to actually sell the low because of margin calls and over exposure to declining names, or lack of foresite to protect their risks. Then they think they can wait, and they think the cost of waiting is not severe when it is declining. Then they lose track of it and it goes nuts to the upside and they are too late.

Don't be that guy.

The market I believe is setting up for a once in a life time opportunity. Either the resistance will fail and we rocket to the upside for a "secular" type of run or even "parabolic" or we fail and correct another 40% or so before rallying and trying again. In either case, we will get some volatility to shake people out and disguise the true direction. But rest assured we will make a big significant move, perhaps twice and possibly both will represent amazing opportunities.

To be honest, the market has undergone many "once and a lifetime opportunities" From the roaring 20s to the crash of 1929 to the bear market after the failed bounce to the 1932 bottom to the 1937 top to the 1942 bottom to the 1965 top and other tops to Gold in the 70s to real estate and interest rates and stocks in the 80s to the 87 crash to the Nikkei to the dot com parabolic move to the housing boom and bust and to the banking bubble and bust and the many other opportunities such as the 2000 top the 2003 bottom the 2007 top and the 2009 low. And we are ignoring all the individual sectors and industries and individual companies that offered opportunities.

Unfortunately sometimes there are too many opportunities that people get distracted. They find a good one only to think another is better and sell out of the first one that would have worked out and then they get trapped in what appeared to be value or a good opportunity. Many often focus on too short of time frame and they are like a mosquito on the *** of a donkey(yes I realize the redundancy). They cannot see the big picture because they are too focused on far too many details on far too short of a time frame. They cannot see the Forrest from the trees.

But when you have yourself one of those extremely significant events and you look at it as "the event of a lifetime" even if you get one in decades, participating in selling the high or buying the low won't hurt you as you will have decades to prepare for the next event. I considered the credit downgrade the opportunity of a lifetime to buy. One could have looked at the flash crash as the extreme volatility that provided an opportunity but It was very difficult to sort out the direction for me personally. But both of those opportunities still pale in comparison to the opportunities like 2007, 2009, oil's peak which came well AFTER 2007.

Nevertheless, those are still opportunities at the time that may feel like they are close to once and a lifetime events and you better be ready for the next one vbbecause it's coming.

We have resistance from DOW connecting 2000-2007 and extending the trendline to about 16,000 in the markets. Is it going to mark a top? Is it going to market a significant aggressive shift into a secular bull market run or parabolic move? It very well could. You better be ready to have enough liquidity and enough exposure to not miss out but if you get that dip, you better get in aggressively if you believe the opportunity presents itself.

It is going to be tricky since it could e a legitimate top forming soon or just a fakeout before the breakout. If you buy the dip you could be trapped so you have to know. If you buy the breakout it could be a trap as well and be a fakeout but it might just be a clean rip or clean top... You better learn what you can about technical analysis and everything else under the sun about market's past action in tops, bottoms, and before and after significant major moves. Study up, for soon a great feast may present itself, and those who have sown shall reap the great harvest..

Then, when you get that opportunity, you have to take aggressive, decisive action.

The key may be preparing for such an action so it is possible BEFORE the event takes place. And perhaps plenty of foresight as you may not have very much time to prepare for the greatest opportunities.

When the opportunity finally is there you certainly will be tempted not to take action. After all, those capable of waiting and passing up opportunities for a greater one, or throwing other good opportunities aside ahead of time to prepare to take that bold decisive action often will find it hard to be both patient and aggressive.

But when you get those pocket aces, you have to be willing to go all in. When you finally get that perfect pitch, you have to swing for the fence. When you have an excellent business selling at a significant discount, you have to be ready to jump on it. When the market is breaking out, you have to aggressively get in. When the market is crashing to it's oversold bottom low, you have to recognize the deep value companies.

There is always opportunity, The question is how much and how great is the opportunity, and will you be in position to win from it?

And will you manage your risks the very large majority of the time so that you are still around and have a great bankroll when the moment comes? The majority miss out on the best opportunities and that is why they are forced to actually sell the low because of margin calls and over exposure to declining names, or lack of foresite to protect their risks. Then they think they can wait, and they think the cost of waiting is not severe when it is declining. Then they lose track of it and it goes nuts to the upside and they are too late.

Don't be that guy.

The market I believe is setting up for a once in a life time opportunity. Either the resistance will fail and we rocket to the upside for a "secular" type of run or even "parabolic" or we fail and correct another 40% or so before rallying and trying again. In either case, we will get some volatility to shake people out and disguise the true direction. But rest assured we will make a big significant move, perhaps twice and possibly both will represent amazing opportunities.

To be honest, the market has undergone many "once and a lifetime opportunities" From the roaring 20s to the crash of 1929 to the bear market after the failed bounce to the 1932 bottom to the 1937 top to the 1942 bottom to the 1965 top and other tops to Gold in the 70s to real estate and interest rates and stocks in the 80s to the 87 crash to the Nikkei to the dot com parabolic move to the housing boom and bust and to the banking bubble and bust and the many other opportunities such as the 2000 top the 2003 bottom the 2007 top and the 2009 low. And we are ignoring all the individual sectors and industries and individual companies that offered opportunities.

Unfortunately sometimes there are too many opportunities that people get distracted. They find a good one only to think another is better and sell out of the first one that would have worked out and then they get trapped in what appeared to be value or a good opportunity. Many often focus on too short of time frame and they are like a mosquito on the *** of a donkey(yes I realize the redundancy). They cannot see the big picture because they are too focused on far too many details on far too short of a time frame. They cannot see the Forrest from the trees.

But when you have yourself one of those extremely significant events and you look at it as "the event of a lifetime" even if you get one in decades, participating in selling the high or buying the low won't hurt you as you will have decades to prepare for the next event. I considered the credit downgrade the opportunity of a lifetime to buy. One could have looked at the flash crash as the extreme volatility that provided an opportunity but It was very difficult to sort out the direction for me personally. But both of those opportunities still pale in comparison to the opportunities like 2007, 2009, oil's peak which came well AFTER 2007.

Nevertheless, those are still opportunities at the time that may feel like they are close to once and a lifetime events and you better be ready for the next one vbbecause it's coming.

We have resistance from DOW connecting 2000-2007 and extending the trendline to about 16,000 in the markets. Is it going to mark a top? Is it going to market a significant aggressive shift into a secular bull market run or parabolic move? It very well could. You better be ready to have enough liquidity and enough exposure to not miss out but if you get that dip, you better get in aggressively if you believe the opportunity presents itself.

It is going to be tricky since it could e a legitimate top forming soon or just a fakeout before the breakout. If you buy the dip you could be trapped so you have to know. If you buy the breakout it could be a trap as well and be a fakeout but it might just be a clean rip or clean top... You better learn what you can about technical analysis and everything else under the sun about market's past action in tops, bottoms, and before and after significant major moves. Study up, for soon a great feast may present itself, and those who have sown shall reap the great harvest..

Subscribe to:

Comments (Atom)

http://www.sciencedirect.com/science/article/pii/S0304405X12002541

http://www.sciencedirect.com/science/article/pii/S0304405X12002541