As an update to this post on Tesla, we can see as expected, Tesla ripped through the 190 mark and kept going. I expected lots of reasons that the ultimate top in Tesla is not in yet. Despite eventual overhead resistance, the tendency for Tesla to rip through 190 and keep going without really slowing down too much gave me plenty of optimism. Even so, I expressed concern that into strength there may be some risk that Tesla would roll over, and even if it wasn't the most likely move, the shares of TESLA could become top heavy and filled with people that either shorted from above and had no reason to expect the move was done, or bought from above and are trapped in from higher prices with little support below.

I was considering eventually shorting into strength due to the risk/reward profile but did not actually place the trade because the stock didn't seem to have trouble finding supply and as I considered, there was enough short sellers that needed to cover to initiate a short squeeze. Traditional volume profile provides reference points for support/resistance but is no guarantee that the psychology of people will act the same way everytime which is why using the past as a reference can be useful.

To the cynical, trying to explain reasons for both sides is a way of hedging your bets and to them I'm trying to speak out of both sides of my mouth. But to the experienced trader, they know you have to always identify a spot in which you are wrong, and manage your risk so that your reward provides a disproportional upside relative to the risk as that allows you to be wrong more often than not and still make money. The high probability trades can work too, but still require a risk that is not too disproportional to the reward.

For example if you are right 75% of the time, the sum of your wins have to add up to more than the sum of your losses. Since you will lose once in 4 trades you need your loss to not exceed 3times your win. You can win 3 times lose on the 4th and still break even.

Conversely if you have a reward to risk of 3 times your loss, you can lose 3 times, win on the 4th and break even so you only have to be right 25% of the time.

Although the case I made for Tesla was higher and that is where I believe the odds and edge was at the time, should Tesla trade higher enough into the [210] range the stock would represent tremendous reward to risk in that you can clearly identify where the bearish case is wrong, and if you are right about the bearish case you can stand to make several times what you are risking.

This is where things can sometimes get confusing because if you have a call position you shouldn't necessarily sell at the same point in which buying a put makes sense. That's because you still are betting on a fast move as much as you are betting directionally and until the move shows signs of absorbing supply you shouldn't sell and you should also develop the habit of letting your winners run and only selling it when there's evidence the trade isn't working. You might however decide to take some profits.

There's sometimes a weird range when both HOLDing an existing bullish trade and buying a new bearish trade may make sense. That's because if for example you buy a put at 208 and sell at 212 while holding a call at 208 and selling if it begins to roll over or show weakness (say around 206) you still have disproportionate upside on both trades so that you don't have to be right about either trade reaching a technical target very often. You aren't basing your trade off of high probability, but high reward when the probability is in your favor. Should the stock breakthrough and keep going, there's a technical target of as high as 270 just based upon falling wedge patterns returning to the prior high. Additionally, if it breaks 270 and continues to respond well, the measured move from the low to the high added onto the high of the pattern puts this stock's target above the all time high and somewhere around 360.

Short squeezes can propel a stock quickly, especially one that has a tendency to move quickly and is typically either a high growth name or a negative earnings name with high potential for completely turning around it's earnings to positive where the valuation can quickly become much more favorable, especially on a big earnings surprise. The mere expectation of higher growth or earnings revision or positive earnings surprises can fuel the shift in sentiment to propel a stock higher with increased confidence and buying. This is another reason that support based upon price history hasn't exactly worked so far for Tesla and why the stock has swung above and below levels that should act as support/resistance in many other stocks.

There's still a chance Tesla's short sellers who covered now start selling. There's still a chance buyers from higher combined with a shift in confidence can reverse the stock below what was resistance and is now more support. If that happens there is a top heavy stock full of potential bagholders who suddenly all want to sell and few buyers below to pick up the pieces which is a recipe for a quick decline. However, as we've moved above this level the stock is currently buyer controlled with buyers and past sellers below that will typically look to buy should prices dip.

As such, if you are looking for a spot to sell this name, you probably will be better waiting until the conditions change or a bearish pattern develops. If you are long you may have taken some profits near the volume profile zone of resistance at around 210 and you may take some more profits as a stock moves higher but I wouldn't sell out completely yet until there's evidence of a reversal, buying euphoria or buying exhaustion or a stock reaches it's next target.

Additionally your target should be consistent with your system which considers reward, risk and winrate and maintains long term profitability with plenty of margin for error.

As always, see the disclaimer.

Tuesday, December 27, 2016

Friday, December 23, 2016

Thursday, December 22, 2016

Eliminating Mistakes With Checklists

Regardless of your trading methodology or system or general strategy, one of the key sources of losses will be mistakes.

Failing to design a wining strategy from the beginning would be a mistake.

Taking too large of a position for your goals would be a mistake.

Not having and following predefined exit and entrance strategies would be a mistake.

Missing an entry or forgetting about a setup you had identified would be a mistake.

From the most common and most damaging or potentially most damaging mistakes you can construct a checklist and develop the habit of following it to avoid those mistakes.

If improperly constructed the checklist itself can lead to other mistakes. For example, one mistake is entering a trade too late or missing a trade opportunity if the checklist itself is too long. Consider estimating how many mistakes you'll make each year with a typical years worth of trades with or without the checklist or how much you'll lose from mistakes as a result of some simulation or projection and see if there's anything you can cut out.

One of my mistakes is being over positioned during times in which I'm optimistic and under positioned when I'm pessimistic. This is partly an emotional component, but partly based upon the availability of setups. I need to regularly practice a procedure (going through a checklist) until it is almost compulsive. I need to create upper end limits on number of position or total exposure to risk and lower end limit. However, that may not necessarily work on it's own. So I may deliberately under position size when I'm excited and want to trade a lot and have created certain methods to ensure I'm never under positioned.

Say I want to put 1% at risk normally. When things are going well I may reduce that to .8%. This way I can create up to 25% more trades before I put any more at risk overall.

I've created sort of an allocation based system for reasons of balancing out under exposure. When the market has sold off and there are few setups and all the trades I have on have stopped out, expired, or are far away from the money in option trades it's hard to gain exposure for me. So instead of being a stock picker in this environment, I choose between either an inverse volatility ETF like XIV or a broad based market ETF like IWM or leveraged ETF like TNA. In these I will increase allocation as the markets get more oversold. I will hold even as other setups become available as the market stabilizes, and only after I begin adding setups and begin getting over exposed do I begin reducing position size and possibly at some point hedging.

A checklist can be part of a trading system, but it isn't the trading system itself. Relying solely on checklists or a group of checklists is too time consuming which is why setting alerts and/or automating orders can combine with checklists to help make up the foundation of a trading system.

Up next, strategies for automating your trading.

Failing to design a wining strategy from the beginning would be a mistake.

Taking too large of a position for your goals would be a mistake.

Not having and following predefined exit and entrance strategies would be a mistake.

Missing an entry or forgetting about a setup you had identified would be a mistake.

From the most common and most damaging or potentially most damaging mistakes you can construct a checklist and develop the habit of following it to avoid those mistakes.

If improperly constructed the checklist itself can lead to other mistakes. For example, one mistake is entering a trade too late or missing a trade opportunity if the checklist itself is too long. Consider estimating how many mistakes you'll make each year with a typical years worth of trades with or without the checklist or how much you'll lose from mistakes as a result of some simulation or projection and see if there's anything you can cut out.

One of my mistakes is being over positioned during times in which I'm optimistic and under positioned when I'm pessimistic. This is partly an emotional component, but partly based upon the availability of setups. I need to regularly practice a procedure (going through a checklist) until it is almost compulsive. I need to create upper end limits on number of position or total exposure to risk and lower end limit. However, that may not necessarily work on it's own. So I may deliberately under position size when I'm excited and want to trade a lot and have created certain methods to ensure I'm never under positioned.

Say I want to put 1% at risk normally. When things are going well I may reduce that to .8%. This way I can create up to 25% more trades before I put any more at risk overall.

I've created sort of an allocation based system for reasons of balancing out under exposure. When the market has sold off and there are few setups and all the trades I have on have stopped out, expired, or are far away from the money in option trades it's hard to gain exposure for me. So instead of being a stock picker in this environment, I choose between either an inverse volatility ETF like XIV or a broad based market ETF like IWM or leveraged ETF like TNA. In these I will increase allocation as the markets get more oversold. I will hold even as other setups become available as the market stabilizes, and only after I begin adding setups and begin getting over exposed do I begin reducing position size and possibly at some point hedging.

A checklist can be part of a trading system, but it isn't the trading system itself. Relying solely on checklists or a group of checklists is too time consuming which is why setting alerts and/or automating orders can combine with checklists to help make up the foundation of a trading system.

Up next, strategies for automating your trading.

Thursday, December 8, 2016

Is Tesla Headed For New Highs OR a sharp Drop?

I'm going to be taking a look at the stock Tesla (ticker TSLA) in a bit, but since we are trying to decide if it's headed for new highs ahead or a sharp drop, I want to compare it to something that did peak and look for some commonalities as well as some differences.

GOLD!

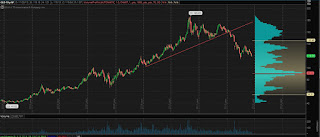

The JPEG above is what GOLD looked like before it collapsed downward, or more specifically, GLD, the ETF that tracks the movements in gold prices.

There were a number of signs that it had topped.

1)Sentiment - Everyone including Mr. T owned gold. Even pawn shops were trying to buy your gold. MR T had a superbowl commercial about cash for gold. "Preppers" were popular and shows about mining for gold were actually on TV.

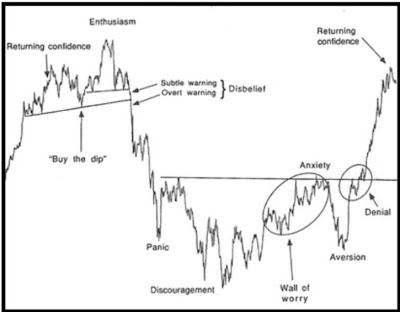

The move even sort of followed the sentiment chart, only the enthusiasm was the climatic move and then the buy the dip and then the last bit of confidence signaling a failure to retake the trend.

2)Climatic move. An instrument moving up very quickly in a short amount of time and ending in a climatic sort of move that is unprecedented and has not happened before over a few weeks or days is a good sign of a condition I call being "maxed out". This is when the buying pressure is so extreme that there simply aren't enough buyers to support these prices. Everyone that wanted to buy already got long, so the smallest bit of selling pressure causes the most amount of damage. You can also see a quick reversal initially, followed by dip buying.

3)Space! You can see a much larger gap between the largest climatic move and the prior trendline. The instrument has built up a lot of energy and people owning stock from much higher that become bagholders and contribute to the panic selling along with those scrambling to preserve their profits or avoid taking a loss.

4)1-2-3 top. A 1-2-3 top is a high followed by a breach of trend, followed by a lower high usually corresponding with a retest of that trendline which was once support and now is resistance.

5)Overbought - Overbought is not that significant of a signal in most cases. Oversold is more significant on it's own. However, overbought conditions at the high combined with some of the other signals provide more confidence that a top is in.

6)Volume Profile - This helps you get a good idea of FUTURE sentiment without looking at sentiment cycle. Imagine prices go lower. Imagine prices go higher. In each instance understand the psychology of both the longs and shorts. In this instance, a higher move would put buyers in control, but there's not really clear evidence that prices can sustain higher levels for very long. It's possible if we didn't know about sentiment and the climactic top and past overbought positions that the buyers would still be firmly in control with plenty of upside and even a move to new highs possible, but it's hard to have any idea of how much upside it had left. While a higher move would put buyers in control with no clear price memory above, a lower move would send the buyers into panic and they would become sellers looking to cover their losses and liquidate. The problem is there are few buyers below that would be looking to sell to defend their buys and their are few sellers below. In other words, those looking to sell outnumber those looking to buy. When that happens you have a FAST move. If GOLD COULD head higher and had the buying power to do so, it would move higher, but the conditions aren't necessarily in place for the buyers to drastically outnumber sellers so the SPEED is not as significant. If you are an options trader, speed is very important.

7)Confirmation. I don't like to wait for confirmation, but if you did, it would look like this

You can see at this point the buyers are underwater and there aren't a lot of prior sellers happy to close their shorts at break even or past buyers happy to buy at the same price as before or just below. The sellers begin to weigh on the buyers.

As expected, a sharp initial drop.

And so GOLD begins to flush and nearly gets through to the past price point just below GOLD at $1000, but too many eager buyers were waiting below and were happy to jump the gun so at least for now it looks like the bottom was formed and prices are now more in balance in their price range without necessarily a lot of fast moves ahead.

Here is what gold looks like now

It's hard to argue at this point for a clear short or a clear long. If the stock were to consolidate just above the next volume pocket, then perhaps you could expect a short move, but following what may be an intermediate 1-2-3 bottom and anything above the overhead trendline would possibly signal a breakout, it's hard to get too excited about shorting. It's also hard to get long knowing there's still significant overhead resistance unless you can get a convincing move higher and continue. Even then you have some price history above so it's probably not the best trade. However, the sentiment is looking more promising again. I did buy a small speculative long in SLV based upon the action in gold, but it's more owned for allocation purposes to reduce overall portfolio correlation and for diversification of multiple asset classes than as an excellent setup that I expect to make money from. It's good enough to argue for a long for the first time in quite some time, so I think there may be some mild returning confidence ahead.

Now we get to look at TSLA

1)Sentiment. Sentiment is less clear. There's an argument for a lot of different points at the sentiment chart. There is an argument for sentiment being too high based upon the attention Elon Musk is getting, but in terms of TSLA stock I don't know if it quite qualifies. We could still be at buy the dip stage just before an enthusiasm move. Or we could have had our breakdown. It's hard to tell, but the last low looks fairly "panicky". We could even be at the "subtle warning around the "disbelief" period. One key in sentiment that you have with TSLA that you didn't in gold is short percentage. With a short percentage of 25% of the shares that float, that isn't at all indicative of enthusiasm, and suggests fast moves on strength as shorts in some cases have no choice but to cover to avoid margin calls.

2)Climactic move - There's really not one. Yes, the rocket to the ultimate high meets the criteria of a very fast move, and it could be a top. However, the volume wasn't extreme at the top, the move itself didn't really launch above prior resistance trendlines upwards, and the ultimate high followed a prior high after resting.

3)Space - I suppose this qualifies.

4)1-2-3 top is certainly made, however what you have is a possible 1-2-3 bottom that follows. You also don't usually get 2 chances to sell a top if it is going to last. A double top pattern certainly does occur and suggest lower prices initially, but not parabolic, ultimate climactic peaks off multiyear rallies where the peak holds for 10-15 years or longer like GOLD in 1981 or the Nikkei in 1989 or Nasdaq in 2000. (possibly interest rates around the world have bottomed and debt markets have peaked? Or possibly one more move before it does?)

5)NOT overbought. It actually began cooling off of overbought before it peaked.

6)Volume profile - The volume profile is as bad as I've seen. Certainly is very concerning, perhaps more so than gold was. However, we have basically an oversold signal AND consolidation and possible inverse H+S forming and intermediate 1-2-3 bottom. While we are certainly below the crucial levels where you might expect a rapid selloff, we had that move downward once and it rejected attempt to stay lower for very long at least initially. The quick reversal rather than bear flag and resumption of downward trend is a little bit positive as it suggests intent to buy dips, even if it's just short sellers covering. Often times shorts covering is the first sign of bottom as it allows the market to find a bid and then on the next dip real buying can occur.

7)confirmation - Sort of confirmation, but not really because rather than breaking down from a trendline you just have a dip below the volume profile. You also have price pattern consolidation which is move indicative of intent to make transactions quietly before the big purchase or sale. Consolidation doesn't always imply direction with as much accuracy as it does a fast move, but this particular consolidation pattern is more often bullish than bearish.

Additional things that may suggest it's not a top.

1)short sale interest - Those that have sold short will HAVE to cover on higher moves and typically will like to do so quickly. Buyers know this and punish the shortsellers by buying at the market and shortsellers can create a chase effect.

2)past price history above 190 and 195 suggest that the overhead resistance so far has not acted as such. Just because typical psychology operates in a particular way doesn't mean it always will. You have to look at what happened recently on moves above or below current prices. You certainly have a number of fast moves through the region just above current prices.

3)Price pattern in many ways from 1-2-3 bottom to consolidation pattern (falling wedge) to inverse H+S all suggest positive things.

4)Volume profile while extremely concerning below, is extremely encouraging if prices get north of 200, and continue their upward momentum, especially knowing short sale interest and past history of movements north of 190.

5)COMBO - The last time the stock was oversold around 190 it rocketed higher to 275 which represents the current neckline of a possible head and shoulders pattern. If you are being picky, the head around 150 where it was nearly oversold didn't quite rally back to the neckline at 275 despite being north of 250, so it technically doesn't qualify for a H+S pattern. However, with all the price history and short sellers that have developed over a long period of time above, a short squeeze higher could potentially ignite all of the buyers to pile on and add on and all the short sellers to flush out higher for a massive run to or even north of 275 and a massive breakout.

6)Other - This isn't necessarily that big of deal, but there are a number of decent longer term setups out there and the dow signal just triggered. The sentiment of the crowd has still been to stay on the sidelines. While last dow signal didn't work very well and drew some people in before selling off, if indeed this is the start of a massive rally in stocks and a run away trend higher that would certainly favor TSLA. But I don't really put much weight at all into this because I have other such bets for this type of action. Ford and GM and Toyota motors and others look to either be nearly breaking out, already have broken out or are at least not suggestive of a decline. Industry participation is a more powerful reason to suggest higher prices rather than a breakdown. Unfortunately TSLA is different enough from the other automakers that even if the industry broke out, it's not clear that TSLA would necessarily participate. Meanwhile alternative energy type of companies that benefit from really high oil prices and alternative energy like TSLA would do have not been in bull market mode so it sort of cancels out a little.

To me, TSLA does not meet the criteria for like a massive top, although the stock is still vulnerable to a fast move and I wont rule a top out completely. It has potential for a really massive move from here in either direction. My current bias is upward and I'm long calls. However, if there's some sort of failure to breakout or sell signal that occurs, I'm going to probably really wish I had bought some puts and may even consider doing so higher. That should tell you a little bit about how quickly the selling could develop.

TSLA is sort of in a "do or die" position, but there's enough there to signal higher prices for me to prefer the long side.

The thing about options is you are not trying to pick the MORE LIKELY move, but you are trying to balance the upside of each decision vs the probability. I prefer to play directionally, but if not, this would probably represent a very good spot for a "straddle" or a "strangle" (where you buy both calls and puts in the same stock). Direction is not so clear, but magnitude of the move ahead is pretty clear. The only question to analyze is the expectation of the move worth the cost of the premium, and whether such a trading position fits your style.

I may grab puts on this yet, or I may add on calls. It's tough to say now, but I'm currently long calls and prefer the long side.

I MUCH prefer options over stock in something like this. I wouldn't dare short it, and I wouldn't necessarily trust a stop to protect me in overnight trading. I'm not much about fundamentals, more about price patterns plus psychology through sentiment as well as supply/demand of the shares and price history.

You can sort of get a good idea of how markets may react by imagining being in different situations.

If I was a trader with a small amount of capital and was currently long or could only buy stock, I'd probably get long and just rely on my ability to trade more quickly to allow me to get out if the current consolidation goes against me. I'd have to be very gutsy to want to short, but might at say 195 knowing that if the stock broke out of the falling wedge I could quickly get out.

If I was an institution controlling large sums of capital I'd probably pressure the shorts and get very long and keep buying until 200 and at that point pay attention to how much my purchases effect price movement. If the price continued higher, I'd keep buying knowing I probably have a market at 200. If price couldn't move much higher, I'd start buying puts to hedge and begin trying to get out and possibly begin getting short a very small amount.

If I had been going short on rallies, I'd be slightly encouraged by the lower highs, but very nervous about the strength of the rallies. a move lower and I'd begin piling on. A strong move higher and I'd be ready to quickly cover, get long calls, start covering and trying to even get long and I'd reevaluate whether or not I wanted to short at 250 or so. Certainly if it holds above 250, I'd have to consider admitting I was wrong and start to try to reverse my position to the long side.

A confirmed head and shoulder would have a price target of about 375. I breakdown would have about a price target of about 40. We currently are at 192.30. So just by price projections, there's a little more upside being long, and a lot more when you factor in the risks of being short. The probability also favors being long in the short term due to the oversold signal and past rejection of lower prices and short squeeze potential vs 25% of float being short and possibly having to cover at some point on the way down. which will create additional bids plus new money buying dips and old money that bought much lower that has more money to add on and may think they won't have a chance to buy much lower.

GOLD!

The JPEG above is what GOLD looked like before it collapsed downward, or more specifically, GLD, the ETF that tracks the movements in gold prices.

There were a number of signs that it had topped.

1)Sentiment - Everyone including Mr. T owned gold. Even pawn shops were trying to buy your gold. MR T had a superbowl commercial about cash for gold. "Preppers" were popular and shows about mining for gold were actually on TV.

The move even sort of followed the sentiment chart, only the enthusiasm was the climatic move and then the buy the dip and then the last bit of confidence signaling a failure to retake the trend.

2)Climatic move. An instrument moving up very quickly in a short amount of time and ending in a climatic sort of move that is unprecedented and has not happened before over a few weeks or days is a good sign of a condition I call being "maxed out". This is when the buying pressure is so extreme that there simply aren't enough buyers to support these prices. Everyone that wanted to buy already got long, so the smallest bit of selling pressure causes the most amount of damage. You can also see a quick reversal initially, followed by dip buying.

3)Space! You can see a much larger gap between the largest climatic move and the prior trendline. The instrument has built up a lot of energy and people owning stock from much higher that become bagholders and contribute to the panic selling along with those scrambling to preserve their profits or avoid taking a loss.

4)1-2-3 top. A 1-2-3 top is a high followed by a breach of trend, followed by a lower high usually corresponding with a retest of that trendline which was once support and now is resistance.

5)Overbought - Overbought is not that significant of a signal in most cases. Oversold is more significant on it's own. However, overbought conditions at the high combined with some of the other signals provide more confidence that a top is in.

6)Volume Profile - This helps you get a good idea of FUTURE sentiment without looking at sentiment cycle. Imagine prices go lower. Imagine prices go higher. In each instance understand the psychology of both the longs and shorts. In this instance, a higher move would put buyers in control, but there's not really clear evidence that prices can sustain higher levels for very long. It's possible if we didn't know about sentiment and the climactic top and past overbought positions that the buyers would still be firmly in control with plenty of upside and even a move to new highs possible, but it's hard to have any idea of how much upside it had left. While a higher move would put buyers in control with no clear price memory above, a lower move would send the buyers into panic and they would become sellers looking to cover their losses and liquidate. The problem is there are few buyers below that would be looking to sell to defend their buys and their are few sellers below. In other words, those looking to sell outnumber those looking to buy. When that happens you have a FAST move. If GOLD COULD head higher and had the buying power to do so, it would move higher, but the conditions aren't necessarily in place for the buyers to drastically outnumber sellers so the SPEED is not as significant. If you are an options trader, speed is very important.

7)Confirmation. I don't like to wait for confirmation, but if you did, it would look like this

You can see at this point the buyers are underwater and there aren't a lot of prior sellers happy to close their shorts at break even or past buyers happy to buy at the same price as before or just below. The sellers begin to weigh on the buyers.

As expected, a sharp initial drop.

A failure to bounce at the next little spot while the buyers above are still looking to sell.

Here is what gold looks like now

It's hard to argue at this point for a clear short or a clear long. If the stock were to consolidate just above the next volume pocket, then perhaps you could expect a short move, but following what may be an intermediate 1-2-3 bottom and anything above the overhead trendline would possibly signal a breakout, it's hard to get too excited about shorting. It's also hard to get long knowing there's still significant overhead resistance unless you can get a convincing move higher and continue. Even then you have some price history above so it's probably not the best trade. However, the sentiment is looking more promising again. I did buy a small speculative long in SLV based upon the action in gold, but it's more owned for allocation purposes to reduce overall portfolio correlation and for diversification of multiple asset classes than as an excellent setup that I expect to make money from. It's good enough to argue for a long for the first time in quite some time, so I think there may be some mild returning confidence ahead.

Now we get to look at TSLA

1)Sentiment. Sentiment is less clear. There's an argument for a lot of different points at the sentiment chart. There is an argument for sentiment being too high based upon the attention Elon Musk is getting, but in terms of TSLA stock I don't know if it quite qualifies. We could still be at buy the dip stage just before an enthusiasm move. Or we could have had our breakdown. It's hard to tell, but the last low looks fairly "panicky". We could even be at the "subtle warning around the "disbelief" period. One key in sentiment that you have with TSLA that you didn't in gold is short percentage. With a short percentage of 25% of the shares that float, that isn't at all indicative of enthusiasm, and suggests fast moves on strength as shorts in some cases have no choice but to cover to avoid margin calls.

2)Climactic move - There's really not one. Yes, the rocket to the ultimate high meets the criteria of a very fast move, and it could be a top. However, the volume wasn't extreme at the top, the move itself didn't really launch above prior resistance trendlines upwards, and the ultimate high followed a prior high after resting.

3)Space - I suppose this qualifies.

4)1-2-3 top is certainly made, however what you have is a possible 1-2-3 bottom that follows. You also don't usually get 2 chances to sell a top if it is going to last. A double top pattern certainly does occur and suggest lower prices initially, but not parabolic, ultimate climactic peaks off multiyear rallies where the peak holds for 10-15 years or longer like GOLD in 1981 or the Nikkei in 1989 or Nasdaq in 2000. (possibly interest rates around the world have bottomed and debt markets have peaked? Or possibly one more move before it does?)

5)NOT overbought. It actually began cooling off of overbought before it peaked.

6)Volume profile - The volume profile is as bad as I've seen. Certainly is very concerning, perhaps more so than gold was. However, we have basically an oversold signal AND consolidation and possible inverse H+S forming and intermediate 1-2-3 bottom. While we are certainly below the crucial levels where you might expect a rapid selloff, we had that move downward once and it rejected attempt to stay lower for very long at least initially. The quick reversal rather than bear flag and resumption of downward trend is a little bit positive as it suggests intent to buy dips, even if it's just short sellers covering. Often times shorts covering is the first sign of bottom as it allows the market to find a bid and then on the next dip real buying can occur.

7)confirmation - Sort of confirmation, but not really because rather than breaking down from a trendline you just have a dip below the volume profile. You also have price pattern consolidation which is move indicative of intent to make transactions quietly before the big purchase or sale. Consolidation doesn't always imply direction with as much accuracy as it does a fast move, but this particular consolidation pattern is more often bullish than bearish.

Additional things that may suggest it's not a top.

1)short sale interest - Those that have sold short will HAVE to cover on higher moves and typically will like to do so quickly. Buyers know this and punish the shortsellers by buying at the market and shortsellers can create a chase effect.

2)past price history above 190 and 195 suggest that the overhead resistance so far has not acted as such. Just because typical psychology operates in a particular way doesn't mean it always will. You have to look at what happened recently on moves above or below current prices. You certainly have a number of fast moves through the region just above current prices.

3)Price pattern in many ways from 1-2-3 bottom to consolidation pattern (falling wedge) to inverse H+S all suggest positive things.

4)Volume profile while extremely concerning below, is extremely encouraging if prices get north of 200, and continue their upward momentum, especially knowing short sale interest and past history of movements north of 190.

5)COMBO - The last time the stock was oversold around 190 it rocketed higher to 275 which represents the current neckline of a possible head and shoulders pattern. If you are being picky, the head around 150 where it was nearly oversold didn't quite rally back to the neckline at 275 despite being north of 250, so it technically doesn't qualify for a H+S pattern. However, with all the price history and short sellers that have developed over a long period of time above, a short squeeze higher could potentially ignite all of the buyers to pile on and add on and all the short sellers to flush out higher for a massive run to or even north of 275 and a massive breakout.

6)Other - This isn't necessarily that big of deal, but there are a number of decent longer term setups out there and the dow signal just triggered. The sentiment of the crowd has still been to stay on the sidelines. While last dow signal didn't work very well and drew some people in before selling off, if indeed this is the start of a massive rally in stocks and a run away trend higher that would certainly favor TSLA. But I don't really put much weight at all into this because I have other such bets for this type of action. Ford and GM and Toyota motors and others look to either be nearly breaking out, already have broken out or are at least not suggestive of a decline. Industry participation is a more powerful reason to suggest higher prices rather than a breakdown. Unfortunately TSLA is different enough from the other automakers that even if the industry broke out, it's not clear that TSLA would necessarily participate. Meanwhile alternative energy type of companies that benefit from really high oil prices and alternative energy like TSLA would do have not been in bull market mode so it sort of cancels out a little.

To me, TSLA does not meet the criteria for like a massive top, although the stock is still vulnerable to a fast move and I wont rule a top out completely. It has potential for a really massive move from here in either direction. My current bias is upward and I'm long calls. However, if there's some sort of failure to breakout or sell signal that occurs, I'm going to probably really wish I had bought some puts and may even consider doing so higher. That should tell you a little bit about how quickly the selling could develop.

TSLA is sort of in a "do or die" position, but there's enough there to signal higher prices for me to prefer the long side.

The thing about options is you are not trying to pick the MORE LIKELY move, but you are trying to balance the upside of each decision vs the probability. I prefer to play directionally, but if not, this would probably represent a very good spot for a "straddle" or a "strangle" (where you buy both calls and puts in the same stock). Direction is not so clear, but magnitude of the move ahead is pretty clear. The only question to analyze is the expectation of the move worth the cost of the premium, and whether such a trading position fits your style.

I may grab puts on this yet, or I may add on calls. It's tough to say now, but I'm currently long calls and prefer the long side.

I MUCH prefer options over stock in something like this. I wouldn't dare short it, and I wouldn't necessarily trust a stop to protect me in overnight trading. I'm not much about fundamentals, more about price patterns plus psychology through sentiment as well as supply/demand of the shares and price history.

You can sort of get a good idea of how markets may react by imagining being in different situations.

If I was a trader with a small amount of capital and was currently long or could only buy stock, I'd probably get long and just rely on my ability to trade more quickly to allow me to get out if the current consolidation goes against me. I'd have to be very gutsy to want to short, but might at say 195 knowing that if the stock broke out of the falling wedge I could quickly get out.

If I was an institution controlling large sums of capital I'd probably pressure the shorts and get very long and keep buying until 200 and at that point pay attention to how much my purchases effect price movement. If the price continued higher, I'd keep buying knowing I probably have a market at 200. If price couldn't move much higher, I'd start buying puts to hedge and begin trying to get out and possibly begin getting short a very small amount.

If I had been going short on rallies, I'd be slightly encouraged by the lower highs, but very nervous about the strength of the rallies. a move lower and I'd begin piling on. A strong move higher and I'd be ready to quickly cover, get long calls, start covering and trying to even get long and I'd reevaluate whether or not I wanted to short at 250 or so. Certainly if it holds above 250, I'd have to consider admitting I was wrong and start to try to reverse my position to the long side.

A confirmed head and shoulder would have a price target of about 375. I breakdown would have about a price target of about 40. We currently are at 192.30. So just by price projections, there's a little more upside being long, and a lot more when you factor in the risks of being short. The probability also favors being long in the short term due to the oversold signal and past rejection of lower prices and short squeeze potential vs 25% of float being short and possibly having to cover at some point on the way down. which will create additional bids plus new money buying dips and old money that bought much lower that has more money to add on and may think they won't have a chance to buy much lower.

Wednesday, December 7, 2016

Startling Gains With This XIV Strategy

This isn't necessarily in opposition to behavioral finance and psychology of capital moving, it just doesn't try to game it. But you could.

The more you try to game individual markets, the more important asymmetric risk/reward and position sizing and cash position becomes.

Brief Recap on position sizing and the Kelly Criterion

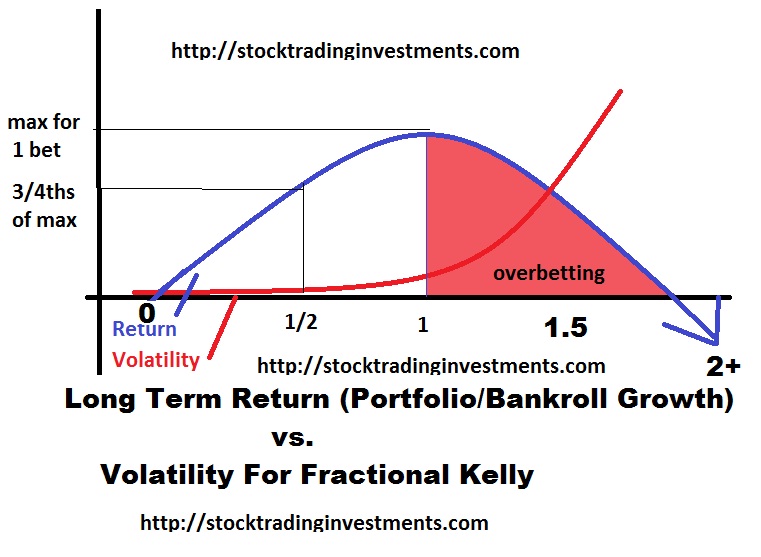

You may want to revisit my older posts if you want more details. This is for those who have seen and it's been awhile, or those who want a quick refresher. Kelly Criterion is a risk management calculation that optimizes geometric growth rate over an infinite time horizon. The actual formula is too aggressive for just about everyone but the revelation is you can get 3/4ths the return over time with half the volatility by risking half as much. This is because a 50% return requires a 100% return to get back to even while a 20% return requires only a 25% return. Volatility can become destructive.

I ran simulations on risk management that showed that for fixed time horizon, the kelly criterion is far too aggressive for most rational people. Betting closer towards the kelly essentially skews the average. For example it might result in one single outlier per few thousand people that is so phenomenal that it skews the average even though everyone else has worse than average results and worse results had you risked less. That suggests that since most people have a set of goals and an associated probability of reaching them in a specific time frame, that as long as the goals are totally unrealistic, the best strategy will be to bet less than the Kelly Criterion to maximize those goals. How much less depends on specific goal and what downside you are willing to accept as a possible consequence in exchange for this risk.

However, those who want to seek more risk, there is a silver lining. This is based upon a single bet (trade) placed and then a result before placing the next trade. Placing individual bets after another. IF instead you trade multiple trades at a lower correlation at the same time, you can risk a little more per trade and have more risk exposed over one time period, with less individual risk. For example, 2 half kelly bets per unit of time with zero correlation between trades is better than 1 full kelly bet since you see 3/4ths of the return with half the volatility and double the amount of trades over a specific time frame. You aren't going to find exactly zero correlation trades with the exact same edge, but it underscores a principal of risk mitigation through lowering correlation.

As you reduce the correlation between trades and lower the fee proportional to each trade to your account and increase the edge, you can actually have a sum of capital at risk that exceeds the kelly criterion for an individual bet. If the kelly says risk 8% and you place two trades with 100% correlation, you'd only want to risk 4% per trade or just pick one and do 8%. However, if the correlation between trades was zero, it'd be like placing 2 separate trades and you could risk 8% each.

If you're betting 1/5th of the kelly criterion, the same relationship applies. The lower the correlation, the more similar it is to completing a full trade and then proceeding to risk capital without the benefit of knowing if your capital will grow or shrink after the first trade.

Uncertainty throws a wrench into the kelly and suggests smaller positions as well. Since there's a chance you're risking far worse as a result of your edge being smaller than you thought, and risking more capital disproportion ally punishes you more than risking too little capital, risking far less as uncertainty increases is correct.

There's lots of reasons to bet far less than the kelly individually, and not risk too much more than the kelly in individual trades.

Allocation With An Edge

If you believe you have an edge, allocation strategy can still be done. Perhaps specifically you think you can pick stocks better than an ETF. Rather than an ETF that has some share of all commodities or multiple ETFs for each commodity with some proportional amount of capital to each, you might try to pick the specific commodity that is the best in terms of giving you the best "edge" (high reward, low risk, high probability of success for the risk/reward.). You also might pick specific trades rather than ETFs and have a mixture of long and short term trades. You might also try to handicap the direction of capital flow.

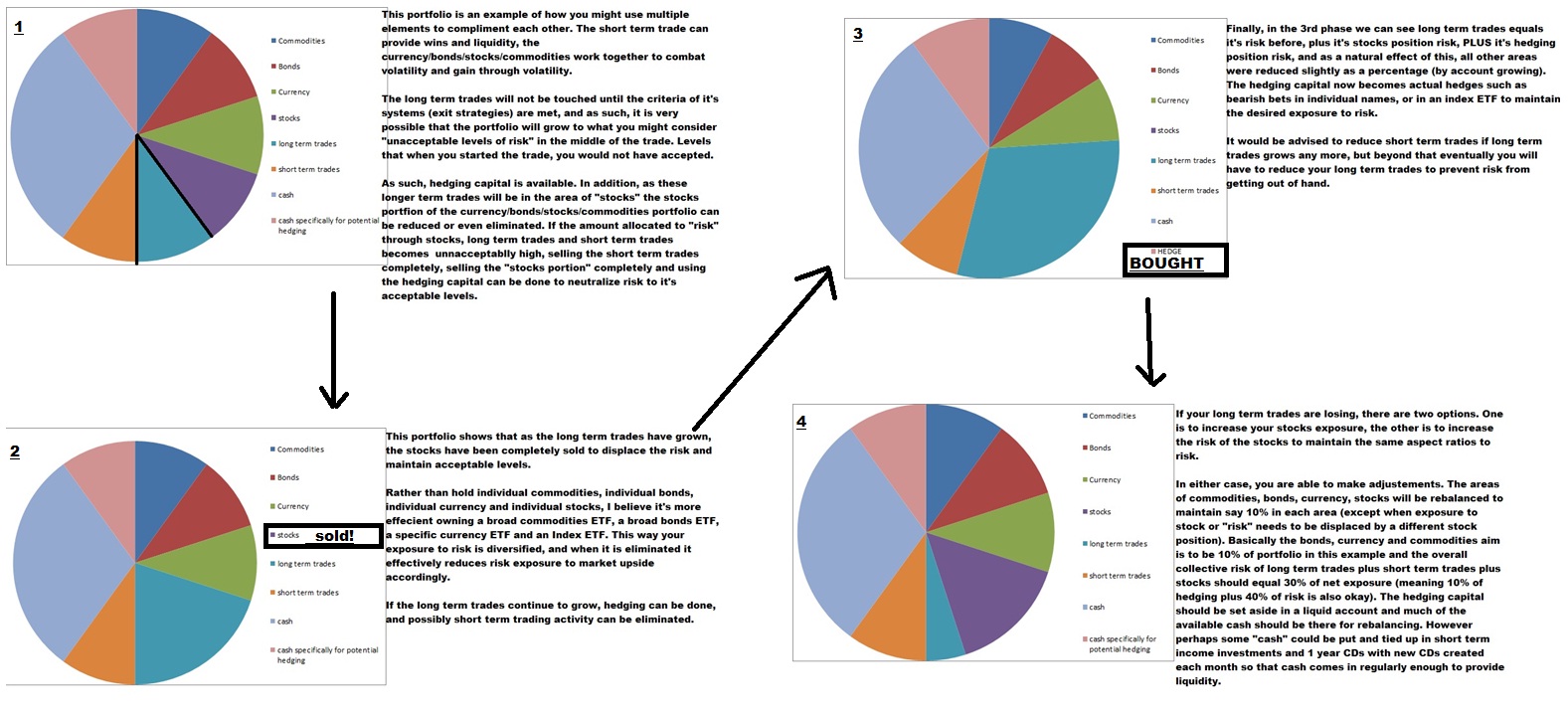

Say for example you believe that the XIV has a positive edge over the long term time horizon and you don't want to change too much about the model. You don't want to adjust the position of XIV. Note (something got screwed up a little with the colors)

Basically you are trying to maintain some kind of parity or allocation percentage and rebalance. Since individual trades have an asymmetric risk and rebalancing prevents you from letting your winners run to their target (and beyond) and is in contrast to the purpose of trading with an edge, you instead can use a broad market ETF like SPY and sell it as your position grows to the point where risk parity is unbalanced in favor of stocks and risk based assets.

Price movement will cause your portfolio to differ from the intended targets. You can hedge as well as reduce allocation towards stocks as broad investment as your individual positions grow. When stocks go down and/or individual positions decline but have not reached their stops, you can increase the stocks allocation to compensate. The principals are very similar to "equilibrium" based asset allocation theory.

But to me the markets irrational price behavior rules the day. Markets function based upon psychology. They may find pricing in a natural way and work over time to promote traffic, but they are almost constantly in disequilibrium which is why you regularly get outsized outperformance in risk/reward in different markets. Identifying how they are irrational is the difficult part. This is why their may be some logic to an equilibrium strategy even if you don't believe markets are hardly ever equilibrium. As long as they eventually swing from extreme to extreme, you benefit from capital swinging and moving to and from asset classes.

Nevertheless, I believe one structural edge is in XIV. I also believe that VIX will revert to the mean and so the XIV purchases perhaps don't have to be timed to profit, however you can still increase allocation of XIV when the VIX is above an average (or at the upper 20% range) and decrease XIV when it's below an average (or below the lower 20% boundary).

Due to the structural edge instruments like VXX are very likely to trend downward over time while XIV capitalizes off of it and trends upwards. You can look into this yourself. The black swan event of things getting increasingly chaotic for a long enough period of time that the XIV is delisted is still possible, but the odds of that are slim, the amount the XIV should gain in the meantime are asymmetric to the risk (It can and has gone up many times the initial investment) and there are measures you can take to avoid disaster (such as a small hedge in SPY LEAP puts that you role over to fight time decay and an allocation strategy with limits to how much capital you commit in total, and increasing the hedge when the VIX is low and being slow to decrease it when it's high or only placing the profits from the XIV at risk in addition to your limited amount you add and a skill edge to be intelligent about when you add).

Markets don't seem to spend much time in equilibrium and instead are over reacting to either side of equilibrium. So you should have a sort of system to try to capitalize.

The XIV also is very complimentary to an options strategy for a good stock picker, because options are cheap when the VIX is low and few people expect large moves (You are looking for situations in which you expect moves many times expectation, If you expect a move historically large when people are expecting a move historically small, you don't have to be right very often for a profitable system). When the VIX is expensive, you don't want to buy too many options, you generally want to sell hedges, and markets traditionally have gone down in temporary flushes. A simple bounce would usually result in the VIX dropping quickly and lots of profit for the XIV. Should things continue to get worse and the VIX increases, it's more opportunity to buy XIV since the VIX should normalize in most situations (and in theory). In some situations you'll also want to increase stock position and reduce cash and other positions.. Alternatively the XIV can sort of substitute risk exposure. As buying occurs, picking stocks becomes possible again and as the vix goes lower, buying options becomes more feasible. The XIV rises to provide capital for you to use as you reduce XIV to maintain the same % risk exposure or even reduce the XIV position. So you can use the capital to consider some positions and/or sell off some of the risk off and broad ETFs in exchange.

As the VIX returns to historically lower ranges, hedges become cheap and individual option trades on both the long and short side become feasible, and often times correlations drop (until the next VIX spike and correlated selloff or risk reset anyways). So it makes total sense to not be in hardly any XIV and to have larger exposure to individual option trades, so long as you can mitigate the correlated selloff risk with your broad market hedges or bearish individual setup should you expect correlations to remain low.

As conditions improve for individual trading, you should care a little less about allocation strategies. As uncertainty increases you want more balance and more cash to reduce portfolio volatility. If the market is one sided so you can't identify hedge and you're willing to risk exposure to correlated selloffs, you may trade even larger without using your hedging capital.

This is just an illustration, and not actual advice of how to park your money, but I find having a visualization of what the extreme conditions look like help you for everywhere between if you can easily define what each extreme looks like and how close you are to each one.

For example, VIX below 12 is usually a good spot to think about reducing XIV substantially. VIX above 20 may be a decent spot to start adding, but if you're really playing the long run, you may want to be a lot more eager to buy XIV and increase XIV than you are to reduce it. Rather than trying to game the individual VIX movements, you can just hold onto it for quite some time.

I've been trying to incorporate some XIV into my trading and it's been saving me. The key is to remember your time horizon should be far, far longer in this than anything else, so be almost "too quick" to buy and increase and very stubborn about selling any shares. You can always try to sell it the "next time" it hits whatever level it's at. I still will sell it but don't worry about missing out on some profit as over time this should melt up. I've been using the occasional short term VXX put option when I prefer something I can actually extract profits from. XIV should grow with the rest of your portfolio mostly and only sold to rebalance. You still are technically going to change positions as other trades become available, but it's a pretty strong edge with in my non expert opinion low risk.

Thursday, December 1, 2016

Quick Ways To Predict The Market: Reading Breadth

Market breadth is an interesting topic. Breadth stats compare the number of stocks up vs the number of stocks down in some way.

Different filters on breadth can provide useful information about what markets are leading.

Many people use different indicators to determine market breadth. Some use a combination of various indicators such as moving averages, weekly movements, last weeks movement Monday to Friday or week movement from the same day last week to the current day this week (Tuesday to Tuesday), or the past X number of trading days. Some use performance metrics and volume as a filter.

One of the most useful breadth analysis that anyone can do is looking for leadership.

Leadership in markets can take various forms.

If a stock is up more than its peers or a particular group or industry or sector is up more than its peers it signifies leadership.

The presence of leadership is dependent upon the underlying conditions of a market.

For example, if the market has been trending downward and slowly you witness the breadth decline first in one particular area, then in others... A sector that is still showing positive gains that are declining and with declining leadership within that sector represent a sector that actually is trailing the others downwards, not leading or indicative that it will lead the market upwards.

This makes breadth a little bit subject to interpretation at times, so it is most useful when you have clarity.

A clear sign of breadth is when breadth has decayed and the market has declined and THEN you have a sector or group begin to show strong breadth after previously showing decaying breadth.

Herding mentality generally takes placce, and I tend to prefer to be a bit more anticipatory in nature when I trade.

You can use multiple time frames as filters for breadth but you should find a way to track breadth fairly regularly. Simply using a spreadsheet may be one good way to observe breadth.

Often times you are looking for divergences... one group not following the others or leading away from the others.

My favorite breadth signal is comparing 1% movers to 4% movers.

Some of my most successful trading occured during a time when I built a spreadsheet where I could track breadth with a push of the button. I also had a separate tab that would track dozens of variables in individual stocks and rate those variables and that would feed into both an individual rating and then a rating by group. Comparisons of the rating by group would then create a separate multiplier to reward the groups that were doing well.

It wasn't just about chasing as I would also reward volatility contraction as a separate filter.

The spreadsheet made my life easier to find individual trades while the breadth tracking was more about capturing short term moves and fiine tuning while also monitoring transactions and timing more aggressive buying or position reduction and raising cash.

If the market would get oversold according to breadth after a sell off, I would begin considering adding XIV or market index. The moment I saw a positive divergence or even a change in breadth from very negative to less negative from the oversold levels, I would start to show interest if the signs were there.

Since I like to buy out of the money options, I was playing for the lower probability, higher upside moves. Thus, the ideal trading conditions would be one in which big moves occur more often, and when the moves were not as "low probability" as they're supposed to be based upon block scholes pricing mechanism. One filter is only buying options with lower implied volatility that you expect to make a bigger than implied move. Another was looking at the trading environment as a whole through breadth measurement.

While individual breadth was not always clear, the one thing that I liked to see is momentum catching on.

That means of the stocks that moved more than 1%, I wanted a high percentage of stocks that moved 4%. I also ideally would see stocks that moved up by any percentage start to improve to be less negative, stocks that moved by more than 1% be even less negative relative to those that moved 0-1%, and stocks that moved 4% be positive.

I'll give you a hypothetical example so you know what I am saying. Let's say market had been in an uptrend but then a correction occurred. The last couple weeks, breadth up until today had been totally negative. In fact it had gone below 20% of stocks moving upward in every category which you probably should consider "oversold". More stocks down than up, more stocks down big than up big by an even greater magnitude, and few stocks catching on for big moves overall, with a downward trend of things getting worse.

Say that initially you notice the following stats early on in the day.

stocks up 2000

stocks down 4500

stocks up 1% or more:1300

stocks down 1% or more:2000

stocks up 4% or more:200

stocks down 4% or more: 250

I also might filter stocks that pass a liquidity test so I ignore stocks that are super small cap or that I won't trade, or that don't have reasonable average daily volume.

You can break these numbers down in several ways.

standard breadth calculation would look at the percentage of the total sampled.

the percentage of stocks moving up vs the total making that sort of move gives you % bullish.

stocks 30.77% bullish on a purely up vs down measurement.

stocks 39.39% bullish of those moving more than 1%.

stocks 44.44% bullish of those moving more than 4%.

Even though breadth is still negative, this is a pretty positive sign in the context of a correction as it signifies within the minority of stocks that do well, there at least is less leadership to the downside in terms of the major movers. It also means when stocks move, they actually seem to catch on. If it were a totally bearish environment even positive news wouldn't stick and capital would rotate out of stocks entirely, rather than into the cream of the crop but out of everything else.

It means there is at least some buying conviction somewhere and it also represents a move out of "oversold" territory. Short sellers could be covering and buyers could begin having some moderate interest again. The market has probably found a bid after seeking a fair market price by moving downward up until now. (see market auction theory)

The next thing I like to do is look at OF those that moved up, what percentage moved at least 1%? What percentage moved at least 4% Of those that moved up 1%, what moved at least 4%?

65% of stocks that moved up in this example moved 1% or more. This is very good. It means if you found a stock that moved up, it had a good chance of moving up with conviction. Only 10% moved 4% or more, this is fairly good since 4% in a day is a big move, but not great. Of those that moved up more than 1%, 15.4% continued up 4% or more. That's a little better than 10% moving 4% or more of all stocks that moved upwards, signalling there is a reasonable "chase effect" in those that catch on, but it could easily be better as well.

This isn't necessarily a total buy signal just yet, but it's enough for me to shift to a less bearish, less cautious stance and begin adding some long exposure. I'm usually at least taking some positions and doing something, so perhaps I take profits on puts and consider taking a small position or some in the money or close to the money call options, or some out of the money calls in some market ETFs or out of the money puts in the VXX if the VIX index is currently high as it often is after a correction.

What I am looking for is those moving more than 4% to turn positive and the numbers to improve.

Say it improves to

40% bullish

45% bullish of those moving 1%+

55% bullish of those moving 4%. Now I am going to start buying aggressively especially if the up 4% crosses the 60% threshold. I am usually looking to shift to bullish or shift to significantly more bullish than I was.

If the secondary numbers improve to where of the stocks that are being bought, a higher percentage of them are being bought up 1% or 4%, I am looking forward to buying options and willing to take more aggressive out of the money options. Although the risk cycle still applies and the market will generally buy quality first, then begin to look for what hasn't moved, I am at least ready to take a more aggressive position.

If the rally sticks as I expect it to, I can rotate from quality stocks up while adding positions at a faster rate than I subtract. After I have the exposure I want, then I'm looking to add positions at the same rate I take those positions off. If breadth gets TOO good in the 75+% territory, I begin reducing position at a faster rate than I add and gradually decreasing exposure.

Aside from an overbought signal, I will also look to reduce exposure if I notice the up 4% stocks are less bullish than the up 1% or if the secondary breadth numbers (percentage of movers going up 1% or 4%) show decline. The context of a rally getting stale or no longer catching on is a sign that things probably aren't as good as people think and at a minimum that the environment is becoming more difficult for option buyers.

You have to be a little bit anticipatory with the ebb and flow of the market and look to move so that you don't get caught too aggressively on one side of the market.

I'm also looking at the inverse of these numbers just to see if anything stands out. In other words, I am looking at the percentage bearish and the percentage of bearish stocks catching on. I don't care too much if stocks are trending in both directions, as long as there's positive trades with the potential for big upside and the market has favorable conditions. In fact, I want a market that isn't too one sided. If trades are catching on to the upside, but not to the downside, this may suggest the market is too correlated, and if it's correlated to the upside, there's greater risk that a downward move will effect all stocks. Being diversified becomes a risk in this environment.

Additionally, if stocks are trending in both directions, it's probably good to find a bearish trade or two as sort of a moderate hedge and to reduce your portfolio's correlation to risk.

ON the other hand, if the market becomes too correlated and most stocks that move downward aren't catching on for very long as well as say overbought conditions or other signs of market correlation, I tend to prefer to hedge in the form of puts in index ETFs.

It's probably a good idea to regularly follow this procedure as well as have a more fixed methodology for exactly how much you buy and how many positions you may hold at once or how much allocation you have in given circumstances so that you aren't susceptible to emotional trading or over exposure without cause.

When I was using the spreadsheet, I would use a separate methodology to try to find hedges, and would tend to have pretty good timing at either buying an individual trade that would profit, or a market hedge that I would put on and take of when conditions improve.

It's possible to grab individual trades, notice the market get overheated and overcorrelated, put on a hedge, see a breakdown or correction and take profits on your hedge only to see the market recover and have enough gains in the same week to profit on both sides. Or conversely take an individual trade on the downside as well as a lot of trades on the upside.

This involves separate skills of stock picking and market directional trading, and the skills of money mangement and position sizing and allocation... but it's useful to develop these skills.

Much of the post has been discussing general market direction, but you can also spot breadth by industry for signs of rotation out of a particular industry and into another. It's just that market breadth has more data points.

When you deal with sectors, you have fewer data points so you may want to just compare up up 0% vs those stocks up only 1%, or 1% vs 2% or 3% instead of 4% so that you have more data points, but the ideas are mostly the same. You might also compare the degree of bullishness or bearishness in one industry or sector relative to another. For example if the basic material stocks are improving and they begin outperforming another industry it is a sign investors and traders are favoring basic materials.

Breadth usually ignores the overall dollar amount moved in and out of trades. For that you'd need to weight each stock by market cap but industry market weighted averages usually will tell you if money is moving into them. However, breadth can be captured specific to large cap, small cap, micro cap as a whole or within a sector as well for an additional filter of information that may be useful.

Also, you want an environment that is productive for how you trade. If you buy covered calls or sell options, you probably don't want big moves so you would probably look for different criteria. I look to have my winners run, so I want to trade when stocks are capable of a big move. The past and current information is not always indicative of the future, but combined with an understanding of psychology and how markets operate and other information it is a very useful tool to sort of get a litmus test of the markets.

Disclaimer: I claim no liability for any trade made or avoided as a result of information published. For my legal protection: All the information on this site is for my own value. It is intended for personal educational purposes only and is not a recommendation of how to use or not use your money. It's not a recommendation to buy or sell a particular stock and you should consult with experts before making a trade.

Different filters on breadth can provide useful information about what markets are leading.

Many people use different indicators to determine market breadth. Some use a combination of various indicators such as moving averages, weekly movements, last weeks movement Monday to Friday or week movement from the same day last week to the current day this week (Tuesday to Tuesday), or the past X number of trading days. Some use performance metrics and volume as a filter.

One of the most useful breadth analysis that anyone can do is looking for leadership.

Leadership in markets can take various forms.

If a stock is up more than its peers or a particular group or industry or sector is up more than its peers it signifies leadership.

The presence of leadership is dependent upon the underlying conditions of a market.

For example, if the market has been trending downward and slowly you witness the breadth decline first in one particular area, then in others... A sector that is still showing positive gains that are declining and with declining leadership within that sector represent a sector that actually is trailing the others downwards, not leading or indicative that it will lead the market upwards.

This makes breadth a little bit subject to interpretation at times, so it is most useful when you have clarity.

A clear sign of breadth is when breadth has decayed and the market has declined and THEN you have a sector or group begin to show strong breadth after previously showing decaying breadth.

Herding mentality generally takes placce, and I tend to prefer to be a bit more anticipatory in nature when I trade.

You can use multiple time frames as filters for breadth but you should find a way to track breadth fairly regularly. Simply using a spreadsheet may be one good way to observe breadth.

Often times you are looking for divergences... one group not following the others or leading away from the others.

My favorite breadth signal is comparing 1% movers to 4% movers.

Some of my most successful trading occured during a time when I built a spreadsheet where I could track breadth with a push of the button. I also had a separate tab that would track dozens of variables in individual stocks and rate those variables and that would feed into both an individual rating and then a rating by group. Comparisons of the rating by group would then create a separate multiplier to reward the groups that were doing well.

It wasn't just about chasing as I would also reward volatility contraction as a separate filter.

The spreadsheet made my life easier to find individual trades while the breadth tracking was more about capturing short term moves and fiine tuning while also monitoring transactions and timing more aggressive buying or position reduction and raising cash.

If the market would get oversold according to breadth after a sell off, I would begin considering adding XIV or market index. The moment I saw a positive divergence or even a change in breadth from very negative to less negative from the oversold levels, I would start to show interest if the signs were there.

Since I like to buy out of the money options, I was playing for the lower probability, higher upside moves. Thus, the ideal trading conditions would be one in which big moves occur more often, and when the moves were not as "low probability" as they're supposed to be based upon block scholes pricing mechanism. One filter is only buying options with lower implied volatility that you expect to make a bigger than implied move. Another was looking at the trading environment as a whole through breadth measurement.

While individual breadth was not always clear, the one thing that I liked to see is momentum catching on.

That means of the stocks that moved more than 1%, I wanted a high percentage of stocks that moved 4%. I also ideally would see stocks that moved up by any percentage start to improve to be less negative, stocks that moved by more than 1% be even less negative relative to those that moved 0-1%, and stocks that moved 4% be positive.

I'll give you a hypothetical example so you know what I am saying. Let's say market had been in an uptrend but then a correction occurred. The last couple weeks, breadth up until today had been totally negative. In fact it had gone below 20% of stocks moving upward in every category which you probably should consider "oversold". More stocks down than up, more stocks down big than up big by an even greater magnitude, and few stocks catching on for big moves overall, with a downward trend of things getting worse.

Say that initially you notice the following stats early on in the day.

stocks up 2000

stocks down 4500

stocks up 1% or more:1300

stocks down 1% or more:2000

stocks up 4% or more:200

stocks down 4% or more: 250

I also might filter stocks that pass a liquidity test so I ignore stocks that are super small cap or that I won't trade, or that don't have reasonable average daily volume.

You can break these numbers down in several ways.

standard breadth calculation would look at the percentage of the total sampled.

the percentage of stocks moving up vs the total making that sort of move gives you % bullish.

stocks 30.77% bullish on a purely up vs down measurement.

stocks 39.39% bullish of those moving more than 1%.

stocks 44.44% bullish of those moving more than 4%.

Even though breadth is still negative, this is a pretty positive sign in the context of a correction as it signifies within the minority of stocks that do well, there at least is less leadership to the downside in terms of the major movers. It also means when stocks move, they actually seem to catch on. If it were a totally bearish environment even positive news wouldn't stick and capital would rotate out of stocks entirely, rather than into the cream of the crop but out of everything else.

It means there is at least some buying conviction somewhere and it also represents a move out of "oversold" territory. Short sellers could be covering and buyers could begin having some moderate interest again. The market has probably found a bid after seeking a fair market price by moving downward up until now. (see market auction theory)

The next thing I like to do is look at OF those that moved up, what percentage moved at least 1%? What percentage moved at least 4% Of those that moved up 1%, what moved at least 4%?

65% of stocks that moved up in this example moved 1% or more. This is very good. It means if you found a stock that moved up, it had a good chance of moving up with conviction. Only 10% moved 4% or more, this is fairly good since 4% in a day is a big move, but not great. Of those that moved up more than 1%, 15.4% continued up 4% or more. That's a little better than 10% moving 4% or more of all stocks that moved upwards, signalling there is a reasonable "chase effect" in those that catch on, but it could easily be better as well.

This isn't necessarily a total buy signal just yet, but it's enough for me to shift to a less bearish, less cautious stance and begin adding some long exposure. I'm usually at least taking some positions and doing something, so perhaps I take profits on puts and consider taking a small position or some in the money or close to the money call options, or some out of the money calls in some market ETFs or out of the money puts in the VXX if the VIX index is currently high as it often is after a correction.

What I am looking for is those moving more than 4% to turn positive and the numbers to improve.

Say it improves to

40% bullish

45% bullish of those moving 1%+

55% bullish of those moving 4%. Now I am going to start buying aggressively especially if the up 4% crosses the 60% threshold. I am usually looking to shift to bullish or shift to significantly more bullish than I was.

If the secondary numbers improve to where of the stocks that are being bought, a higher percentage of them are being bought up 1% or 4%, I am looking forward to buying options and willing to take more aggressive out of the money options. Although the risk cycle still applies and the market will generally buy quality first, then begin to look for what hasn't moved, I am at least ready to take a more aggressive position.

If the rally sticks as I expect it to, I can rotate from quality stocks up while adding positions at a faster rate than I subtract. After I have the exposure I want, then I'm looking to add positions at the same rate I take those positions off. If breadth gets TOO good in the 75+% territory, I begin reducing position at a faster rate than I add and gradually decreasing exposure.

Aside from an overbought signal, I will also look to reduce exposure if I notice the up 4% stocks are less bullish than the up 1% or if the secondary breadth numbers (percentage of movers going up 1% or 4%) show decline. The context of a rally getting stale or no longer catching on is a sign that things probably aren't as good as people think and at a minimum that the environment is becoming more difficult for option buyers.

You have to be a little bit anticipatory with the ebb and flow of the market and look to move so that you don't get caught too aggressively on one side of the market.

I'm also looking at the inverse of these numbers just to see if anything stands out. In other words, I am looking at the percentage bearish and the percentage of bearish stocks catching on. I don't care too much if stocks are trending in both directions, as long as there's positive trades with the potential for big upside and the market has favorable conditions. In fact, I want a market that isn't too one sided. If trades are catching on to the upside, but not to the downside, this may suggest the market is too correlated, and if it's correlated to the upside, there's greater risk that a downward move will effect all stocks. Being diversified becomes a risk in this environment.

Additionally, if stocks are trending in both directions, it's probably good to find a bearish trade or two as sort of a moderate hedge and to reduce your portfolio's correlation to risk.

ON the other hand, if the market becomes too correlated and most stocks that move downward aren't catching on for very long as well as say overbought conditions or other signs of market correlation, I tend to prefer to hedge in the form of puts in index ETFs.

It's probably a good idea to regularly follow this procedure as well as have a more fixed methodology for exactly how much you buy and how many positions you may hold at once or how much allocation you have in given circumstances so that you aren't susceptible to emotional trading or over exposure without cause.

When I was using the spreadsheet, I would use a separate methodology to try to find hedges, and would tend to have pretty good timing at either buying an individual trade that would profit, or a market hedge that I would put on and take of when conditions improve.

It's possible to grab individual trades, notice the market get overheated and overcorrelated, put on a hedge, see a breakdown or correction and take profits on your hedge only to see the market recover and have enough gains in the same week to profit on both sides. Or conversely take an individual trade on the downside as well as a lot of trades on the upside.

This involves separate skills of stock picking and market directional trading, and the skills of money mangement and position sizing and allocation... but it's useful to develop these skills.

Much of the post has been discussing general market direction, but you can also spot breadth by industry for signs of rotation out of a particular industry and into another. It's just that market breadth has more data points.