This isn't necessarily in opposition to behavioral finance and psychology of capital moving, it just doesn't try to game it. But you could.

The more you try to game individual markets, the more important asymmetric risk/reward and position sizing and cash position becomes.

Brief Recap on position sizing and the Kelly Criterion

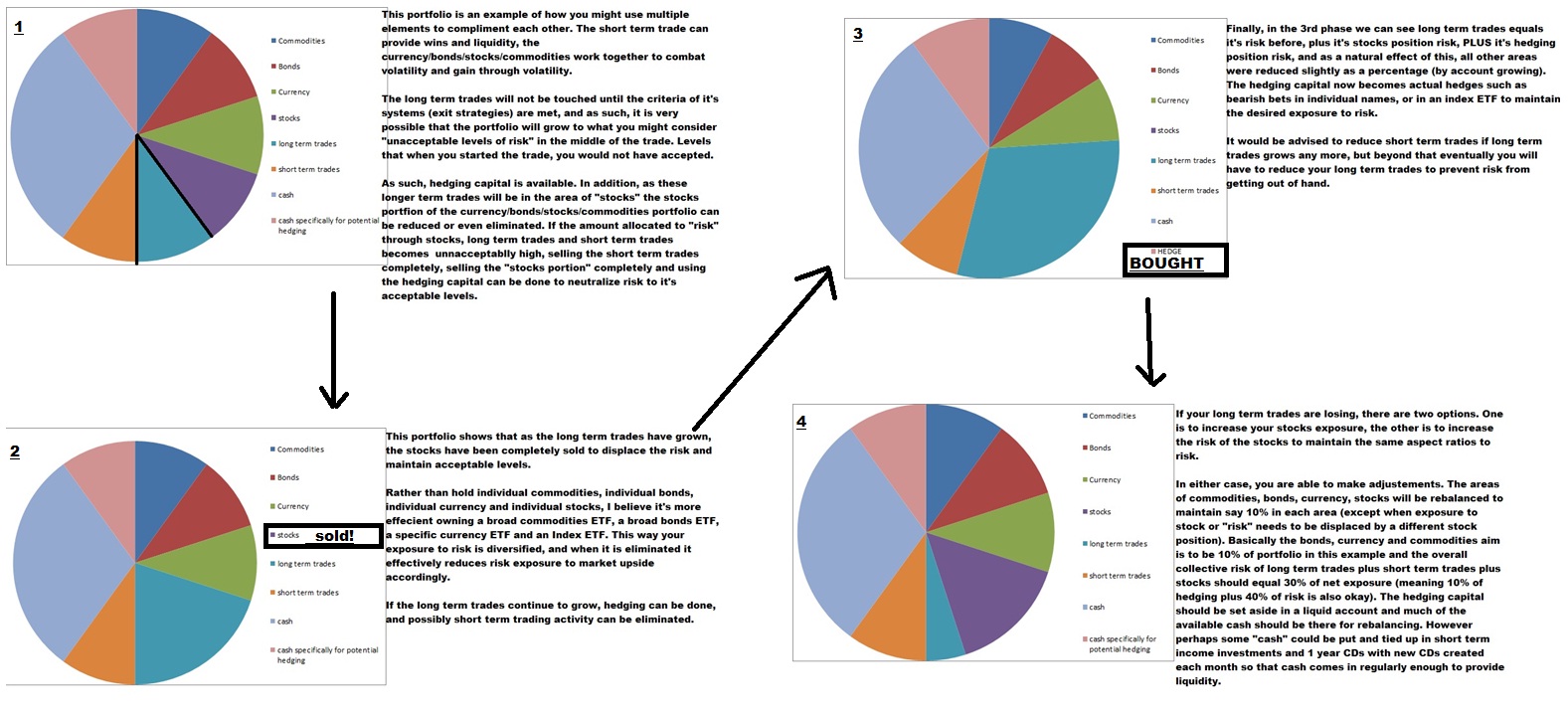

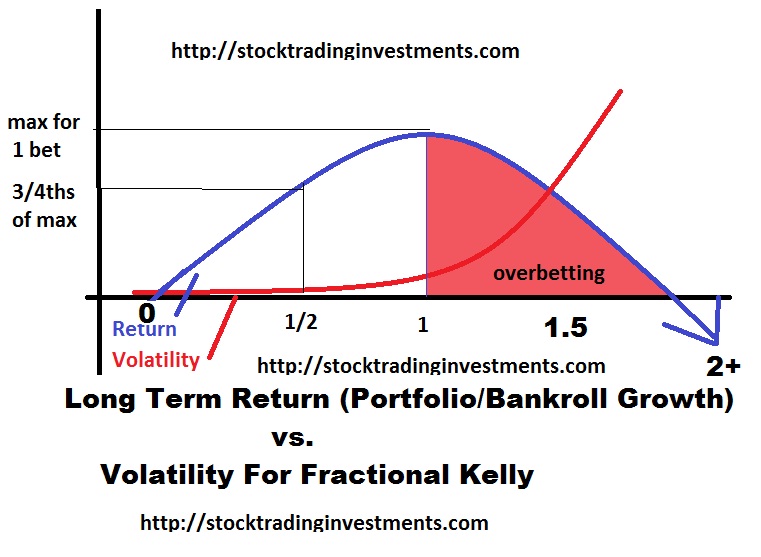

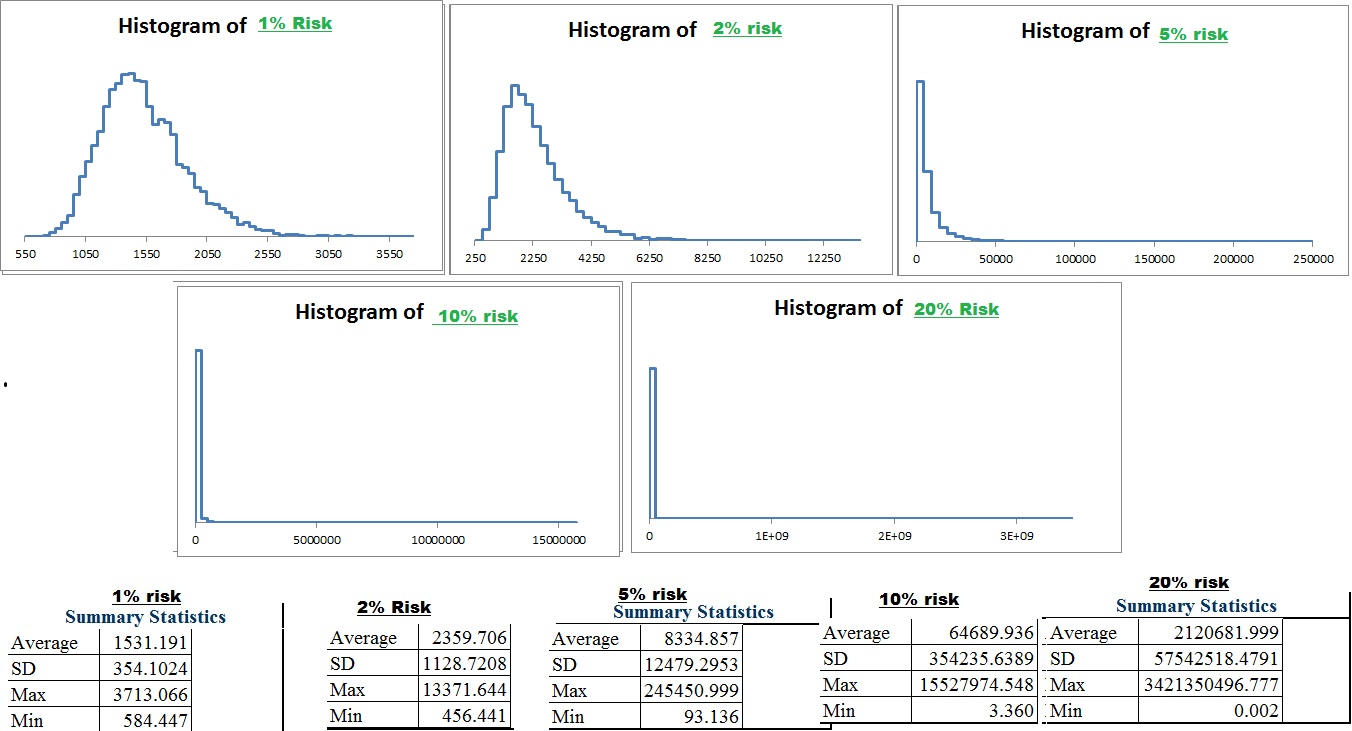

You may want to revisit my older posts if you want more details. This is for those who have seen and it's been awhile, or those who want a quick refresher. Kelly Criterion is a risk management calculation that optimizes geometric growth rate over an infinite time horizon. The actual formula is too aggressive for just about everyone but the revelation is you can get 3/4ths the return over time with half the volatility by risking half as much. This is because a 50% return requires a 100% return to get back to even while a 20% return requires only a 25% return. Volatility can become destructive.

I ran simulations on risk management that showed that for fixed time horizon, the kelly criterion is far too aggressive for most rational people. Betting closer towards the kelly essentially skews the average. For example it might result in one single outlier per few thousand people that is so phenomenal that it skews the average even though everyone else has worse than average results and worse results had you risked less. That suggests that since most people have a set of goals and an associated probability of reaching them in a specific time frame, that as long as the goals are totally unrealistic, the best strategy will be to bet less than the Kelly Criterion to maximize those goals. How much less depends on specific goal and what downside you are willing to accept as a possible consequence in exchange for this risk.

However, those who want to seek more risk, there is a silver lining. This is based upon a single bet (trade) placed and then a result before placing the next trade. Placing individual bets after another. IF instead you trade multiple trades at a lower correlation at the same time, you can risk a little more per trade and have more risk exposed over one time period, with less individual risk. For example, 2 half kelly bets per unit of time with zero correlation between trades is better than 1 full kelly bet since you see 3/4ths of the return with half the volatility and double the amount of trades over a specific time frame. You aren't going to find exactly zero correlation trades with the exact same edge, but it underscores a principal of risk mitigation through lowering correlation.

As you reduce the correlation between trades and lower the fee proportional to each trade to your account and increase the edge, you can actually have a sum of capital at risk that exceeds the kelly criterion for an individual bet. If the kelly says risk 8% and you place two trades with 100% correlation, you'd only want to risk 4% per trade or just pick one and do 8%. However, if the correlation between trades was zero, it'd be like placing 2 separate trades and you could risk 8% each.

If you're betting 1/5th of the kelly criterion, the same relationship applies. The lower the correlation, the more similar it is to completing a full trade and then proceeding to risk capital without the benefit of knowing if your capital will grow or shrink after the first trade.

Uncertainty throws a wrench into the kelly and suggests smaller positions as well. Since there's a chance you're risking far worse as a result of your edge being smaller than you thought, and risking more capital disproportion ally punishes you more than risking too little capital, risking far less as uncertainty increases is correct.

There's lots of reasons to bet far less than the kelly individually, and not risk too much more than the kelly in individual trades.

Allocation With An Edge

If you believe you have an edge, allocation strategy can still be done. Perhaps specifically you think you can pick stocks better than an ETF. Rather than an ETF that has some share of all commodities or multiple ETFs for each commodity with some proportional amount of capital to each, you might try to pick the specific commodity that is the best in terms of giving you the best "edge" (high reward, low risk, high probability of success for the risk/reward.). You also might pick specific trades rather than ETFs and have a mixture of long and short term trades. You might also try to handicap the direction of capital flow.

Say for example you believe that the XIV has a positive edge over the long term time horizon and you don't want to change too much about the model. You don't want to adjust the position of XIV. Note (something got screwed up a little with the colors)

Basically you are trying to maintain some kind of parity or allocation percentage and rebalance. Since individual trades have an asymmetric risk and rebalancing prevents you from letting your winners run to their target (and beyond) and is in contrast to the purpose of trading with an edge, you instead can use a broad market ETF like SPY and sell it as your position grows to the point where risk parity is unbalanced in favor of stocks and risk based assets.

Price movement will cause your portfolio to differ from the intended targets. You can hedge as well as reduce allocation towards stocks as broad investment as your individual positions grow. When stocks go down and/or individual positions decline but have not reached their stops, you can increase the stocks allocation to compensate. The principals are very similar to "equilibrium" based asset allocation theory.

But to me the markets irrational price behavior rules the day. Markets function based upon psychology. They may find pricing in a natural way and work over time to promote traffic, but they are almost constantly in disequilibrium which is why you regularly get outsized outperformance in risk/reward in different markets. Identifying how they are irrational is the difficult part. This is why their may be some logic to an equilibrium strategy even if you don't believe markets are hardly ever equilibrium. As long as they eventually swing from extreme to extreme, you benefit from capital swinging and moving to and from asset classes.

Nevertheless, I believe one structural edge is in XIV. I also believe that VIX will revert to the mean and so the XIV purchases perhaps don't have to be timed to profit, however you can still increase allocation of XIV when the VIX is above an average (or at the upper 20% range) and decrease XIV when it's below an average (or below the lower 20% boundary).

Due to the structural edge instruments like VXX are very likely to trend downward over time while XIV capitalizes off of it and trends upwards. You can look into this yourself. The black swan event of things getting increasingly chaotic for a long enough period of time that the XIV is delisted is still possible, but the odds of that are slim, the amount the XIV should gain in the meantime are asymmetric to the risk (It can and has gone up many times the initial investment) and there are measures you can take to avoid disaster (such as a small hedge in SPY LEAP puts that you role over to fight time decay and an allocation strategy with limits to how much capital you commit in total, and increasing the hedge when the VIX is low and being slow to decrease it when it's high or only placing the profits from the XIV at risk in addition to your limited amount you add and a skill edge to be intelligent about when you add).

Markets don't seem to spend much time in equilibrium and instead are over reacting to either side of equilibrium. So you should have a sort of system to try to capitalize.

The XIV also is very complimentary to an options strategy for a good stock picker, because options are cheap when the VIX is low and few people expect large moves (You are looking for situations in which you expect moves many times expectation, If you expect a move historically large when people are expecting a move historically small, you don't have to be right very often for a profitable system). When the VIX is expensive, you don't want to buy too many options, you generally want to sell hedges, and markets traditionally have gone down in temporary flushes. A simple bounce would usually result in the VIX dropping quickly and lots of profit for the XIV. Should things continue to get worse and the VIX increases, it's more opportunity to buy XIV since the VIX should normalize in most situations (and in theory). In some situations you'll also want to increase stock position and reduce cash and other positions.. Alternatively the XIV can sort of substitute risk exposure. As buying occurs, picking stocks becomes possible again and as the vix goes lower, buying options becomes more feasible. The XIV rises to provide capital for you to use as you reduce XIV to maintain the same % risk exposure or even reduce the XIV position. So you can use the capital to consider some positions and/or sell off some of the risk off and broad ETFs in exchange.

As the VIX returns to historically lower ranges, hedges become cheap and individual option trades on both the long and short side become feasible, and often times correlations drop (until the next VIX spike and correlated selloff or risk reset anyways). So it makes total sense to not be in hardly any XIV and to have larger exposure to individual option trades, so long as you can mitigate the correlated selloff risk with your broad market hedges or bearish individual setup should you expect correlations to remain low.

As conditions improve for individual trading, you should care a little less about allocation strategies. As uncertainty increases you want more balance and more cash to reduce portfolio volatility. If the market is one sided so you can't identify hedge and you're willing to risk exposure to correlated selloffs, you may trade even larger without using your hedging capital.

This is just an illustration, and not actual advice of how to park your money, but I find having a visualization of what the extreme conditions look like help you for everywhere between if you can easily define what each extreme looks like and how close you are to each one.

For example, VIX below 12 is usually a good spot to think about reducing XIV substantially. VIX above 20 may be a decent spot to start adding, but if you're really playing the long run, you may want to be a lot more eager to buy XIV and increase XIV than you are to reduce it. Rather than trying to game the individual VIX movements, you can just hold onto it for quite some time.

I've been trying to incorporate some XIV into my trading and it's been saving me. The key is to remember your time horizon should be far, far longer in this than anything else, so be almost "too quick" to buy and increase and very stubborn about selling any shares. You can always try to sell it the "next time" it hits whatever level it's at. I still will sell it but don't worry about missing out on some profit as over time this should melt up. I've been using the occasional short term VXX put option when I prefer something I can actually extract profits from. XIV should grow with the rest of your portfolio mostly and only sold to rebalance. You still are technically going to change positions as other trades become available, but it's a pretty strong edge with in my non expert opinion low risk.

No comments:

Post a Comment