GOLD!

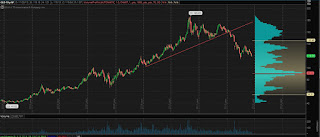

The JPEG above is what GOLD looked like before it collapsed downward, or more specifically, GLD, the ETF that tracks the movements in gold prices.

There were a number of signs that it had topped.

1)Sentiment - Everyone including Mr. T owned gold. Even pawn shops were trying to buy your gold. MR T had a superbowl commercial about cash for gold. "Preppers" were popular and shows about mining for gold were actually on TV.

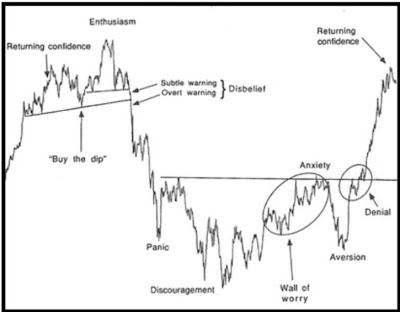

The move even sort of followed the sentiment chart, only the enthusiasm was the climatic move and then the buy the dip and then the last bit of confidence signaling a failure to retake the trend.

2)Climatic move. An instrument moving up very quickly in a short amount of time and ending in a climatic sort of move that is unprecedented and has not happened before over a few weeks or days is a good sign of a condition I call being "maxed out". This is when the buying pressure is so extreme that there simply aren't enough buyers to support these prices. Everyone that wanted to buy already got long, so the smallest bit of selling pressure causes the most amount of damage. You can also see a quick reversal initially, followed by dip buying.

3)Space! You can see a much larger gap between the largest climatic move and the prior trendline. The instrument has built up a lot of energy and people owning stock from much higher that become bagholders and contribute to the panic selling along with those scrambling to preserve their profits or avoid taking a loss.

4)1-2-3 top. A 1-2-3 top is a high followed by a breach of trend, followed by a lower high usually corresponding with a retest of that trendline which was once support and now is resistance.

5)Overbought - Overbought is not that significant of a signal in most cases. Oversold is more significant on it's own. However, overbought conditions at the high combined with some of the other signals provide more confidence that a top is in.

6)Volume Profile - This helps you get a good idea of FUTURE sentiment without looking at sentiment cycle. Imagine prices go lower. Imagine prices go higher. In each instance understand the psychology of both the longs and shorts. In this instance, a higher move would put buyers in control, but there's not really clear evidence that prices can sustain higher levels for very long. It's possible if we didn't know about sentiment and the climactic top and past overbought positions that the buyers would still be firmly in control with plenty of upside and even a move to new highs possible, but it's hard to have any idea of how much upside it had left. While a higher move would put buyers in control with no clear price memory above, a lower move would send the buyers into panic and they would become sellers looking to cover their losses and liquidate. The problem is there are few buyers below that would be looking to sell to defend their buys and their are few sellers below. In other words, those looking to sell outnumber those looking to buy. When that happens you have a FAST move. If GOLD COULD head higher and had the buying power to do so, it would move higher, but the conditions aren't necessarily in place for the buyers to drastically outnumber sellers so the SPEED is not as significant. If you are an options trader, speed is very important.

7)Confirmation. I don't like to wait for confirmation, but if you did, it would look like this

You can see at this point the buyers are underwater and there aren't a lot of prior sellers happy to close their shorts at break even or past buyers happy to buy at the same price as before or just below. The sellers begin to weigh on the buyers.

As expected, a sharp initial drop.

A failure to bounce at the next little spot while the buyers above are still looking to sell.

Here is what gold looks like now

It's hard to argue at this point for a clear short or a clear long. If the stock were to consolidate just above the next volume pocket, then perhaps you could expect a short move, but following what may be an intermediate 1-2-3 bottom and anything above the overhead trendline would possibly signal a breakout, it's hard to get too excited about shorting. It's also hard to get long knowing there's still significant overhead resistance unless you can get a convincing move higher and continue. Even then you have some price history above so it's probably not the best trade. However, the sentiment is looking more promising again. I did buy a small speculative long in SLV based upon the action in gold, but it's more owned for allocation purposes to reduce overall portfolio correlation and for diversification of multiple asset classes than as an excellent setup that I expect to make money from. It's good enough to argue for a long for the first time in quite some time, so I think there may be some mild returning confidence ahead.

Now we get to look at TSLA

1)Sentiment. Sentiment is less clear. There's an argument for a lot of different points at the sentiment chart. There is an argument for sentiment being too high based upon the attention Elon Musk is getting, but in terms of TSLA stock I don't know if it quite qualifies. We could still be at buy the dip stage just before an enthusiasm move. Or we could have had our breakdown. It's hard to tell, but the last low looks fairly "panicky". We could even be at the "subtle warning around the "disbelief" period. One key in sentiment that you have with TSLA that you didn't in gold is short percentage. With a short percentage of 25% of the shares that float, that isn't at all indicative of enthusiasm, and suggests fast moves on strength as shorts in some cases have no choice but to cover to avoid margin calls.

2)Climactic move - There's really not one. Yes, the rocket to the ultimate high meets the criteria of a very fast move, and it could be a top. However, the volume wasn't extreme at the top, the move itself didn't really launch above prior resistance trendlines upwards, and the ultimate high followed a prior high after resting.

3)Space - I suppose this qualifies.

4)1-2-3 top is certainly made, however what you have is a possible 1-2-3 bottom that follows. You also don't usually get 2 chances to sell a top if it is going to last. A double top pattern certainly does occur and suggest lower prices initially, but not parabolic, ultimate climactic peaks off multiyear rallies where the peak holds for 10-15 years or longer like GOLD in 1981 or the Nikkei in 1989 or Nasdaq in 2000. (possibly interest rates around the world have bottomed and debt markets have peaked? Or possibly one more move before it does?)

5)NOT overbought. It actually began cooling off of overbought before it peaked.

6)Volume profile - The volume profile is as bad as I've seen. Certainly is very concerning, perhaps more so than gold was. However, we have basically an oversold signal AND consolidation and possible inverse H+S forming and intermediate 1-2-3 bottom. While we are certainly below the crucial levels where you might expect a rapid selloff, we had that move downward once and it rejected attempt to stay lower for very long at least initially. The quick reversal rather than bear flag and resumption of downward trend is a little bit positive as it suggests intent to buy dips, even if it's just short sellers covering. Often times shorts covering is the first sign of bottom as it allows the market to find a bid and then on the next dip real buying can occur.

7)confirmation - Sort of confirmation, but not really because rather than breaking down from a trendline you just have a dip below the volume profile. You also have price pattern consolidation which is move indicative of intent to make transactions quietly before the big purchase or sale. Consolidation doesn't always imply direction with as much accuracy as it does a fast move, but this particular consolidation pattern is more often bullish than bearish.

Additional things that may suggest it's not a top.

1)short sale interest - Those that have sold short will HAVE to cover on higher moves and typically will like to do so quickly. Buyers know this and punish the shortsellers by buying at the market and shortsellers can create a chase effect.

2)past price history above 190 and 195 suggest that the overhead resistance so far has not acted as such. Just because typical psychology operates in a particular way doesn't mean it always will. You have to look at what happened recently on moves above or below current prices. You certainly have a number of fast moves through the region just above current prices.

3)Price pattern in many ways from 1-2-3 bottom to consolidation pattern (falling wedge) to inverse H+S all suggest positive things.

4)Volume profile while extremely concerning below, is extremely encouraging if prices get north of 200, and continue their upward momentum, especially knowing short sale interest and past history of movements north of 190.

5)COMBO - The last time the stock was oversold around 190 it rocketed higher to 275 which represents the current neckline of a possible head and shoulders pattern. If you are being picky, the head around 150 where it was nearly oversold didn't quite rally back to the neckline at 275 despite being north of 250, so it technically doesn't qualify for a H+S pattern. However, with all the price history and short sellers that have developed over a long period of time above, a short squeeze higher could potentially ignite all of the buyers to pile on and add on and all the short sellers to flush out higher for a massive run to or even north of 275 and a massive breakout.

6)Other - This isn't necessarily that big of deal, but there are a number of decent longer term setups out there and the dow signal just triggered. The sentiment of the crowd has still been to stay on the sidelines. While last dow signal didn't work very well and drew some people in before selling off, if indeed this is the start of a massive rally in stocks and a run away trend higher that would certainly favor TSLA. But I don't really put much weight at all into this because I have other such bets for this type of action. Ford and GM and Toyota motors and others look to either be nearly breaking out, already have broken out or are at least not suggestive of a decline. Industry participation is a more powerful reason to suggest higher prices rather than a breakdown. Unfortunately TSLA is different enough from the other automakers that even if the industry broke out, it's not clear that TSLA would necessarily participate. Meanwhile alternative energy type of companies that benefit from really high oil prices and alternative energy like TSLA would do have not been in bull market mode so it sort of cancels out a little.

To me, TSLA does not meet the criteria for like a massive top, although the stock is still vulnerable to a fast move and I wont rule a top out completely. It has potential for a really massive move from here in either direction. My current bias is upward and I'm long calls. However, if there's some sort of failure to breakout or sell signal that occurs, I'm going to probably really wish I had bought some puts and may even consider doing so higher. That should tell you a little bit about how quickly the selling could develop.

TSLA is sort of in a "do or die" position, but there's enough there to signal higher prices for me to prefer the long side.

The thing about options is you are not trying to pick the MORE LIKELY move, but you are trying to balance the upside of each decision vs the probability. I prefer to play directionally, but if not, this would probably represent a very good spot for a "straddle" or a "strangle" (where you buy both calls and puts in the same stock). Direction is not so clear, but magnitude of the move ahead is pretty clear. The only question to analyze is the expectation of the move worth the cost of the premium, and whether such a trading position fits your style.

I may grab puts on this yet, or I may add on calls. It's tough to say now, but I'm currently long calls and prefer the long side.

I MUCH prefer options over stock in something like this. I wouldn't dare short it, and I wouldn't necessarily trust a stop to protect me in overnight trading. I'm not much about fundamentals, more about price patterns plus psychology through sentiment as well as supply/demand of the shares and price history.

You can sort of get a good idea of how markets may react by imagining being in different situations.

If I was a trader with a small amount of capital and was currently long or could only buy stock, I'd probably get long and just rely on my ability to trade more quickly to allow me to get out if the current consolidation goes against me. I'd have to be very gutsy to want to short, but might at say 195 knowing that if the stock broke out of the falling wedge I could quickly get out.

If I was an institution controlling large sums of capital I'd probably pressure the shorts and get very long and keep buying until 200 and at that point pay attention to how much my purchases effect price movement. If the price continued higher, I'd keep buying knowing I probably have a market at 200. If price couldn't move much higher, I'd start buying puts to hedge and begin trying to get out and possibly begin getting short a very small amount.

If I had been going short on rallies, I'd be slightly encouraged by the lower highs, but very nervous about the strength of the rallies. a move lower and I'd begin piling on. A strong move higher and I'd be ready to quickly cover, get long calls, start covering and trying to even get long and I'd reevaluate whether or not I wanted to short at 250 or so. Certainly if it holds above 250, I'd have to consider admitting I was wrong and start to try to reverse my position to the long side.

A confirmed head and shoulder would have a price target of about 375. I breakdown would have about a price target of about 40. We currently are at 192.30. So just by price projections, there's a little more upside being long, and a lot more when you factor in the risks of being short. The probability also favors being long in the short term due to the oversold signal and past rejection of lower prices and short squeeze potential vs 25% of float being short and possibly having to cover at some point on the way down. which will create additional bids plus new money buying dips and old money that bought much lower that has more money to add on and may think they won't have a chance to buy much lower.

No comments:

Post a Comment